- Proof Of Intel

- Posts

- Arbitrum's $20B Flex, Blockchain Coexistence Debate, Crypto's $8.6B Deal Mania, and Nvidia's Groq Power Play!

Arbitrum's $20B Flex, Blockchain Coexistence Debate, Crypto's $8.6B Deal Mania, and Nvidia's Groq Power Play!

🎄From layer-2 milestones to record-breaking acquisitions, Trump-fueled M&A madness to AI chip warfare – we've got it all!

Hey there, PoI readers! 🎄✨

Merry Christmas and happy holidays! As twinkling lights, warm cocoa, and year-end cheer fill the air, Mochi is back with a festive sack full of tantalizing tech and Web3 stories. From Arbitrum crossing a jaw-dropping $20B milestone, and the ever-buzzing Solana vs. Ethereum coexistence debate, to crypto’s record-breaking $8.6B deal frenzy and Nvidia’s power move on Groq, there’s no shortage of excitement under the digital tree.

So grab a cookie, settle in, and buckle up for a merry ride through the winter wonderland of digital assets and innovation. 🎅

INTEL BRIEF

🟧 Offchain Labs bought more ARB tokens to show confidence in Arbitrum as the network hits $20B in secured value despite weak governance token sentiment.

🟧 Dragonfly VC's Rob Hadick says Solana and Ethereum will both succeed in tokenization as different blockchains serve different use cases, with plenty of room for coexistence.

🟧 Crypto M&A hit a record $8.6B in 2025 with 267 deals as Trump's pro-crypto policies boosted confidence, led by Coinbase's $2.9B Deribit acquisition.

🟧 Nvidia licensed AI chip rival Groq's tech and hired its CEO Jonathan Ross in a deal reportedly worth $20B, boosting its dominance in AI chip manufacturing.

Offchain Labs Buys More ARB Tokens as Arbitrum Hits $20B Milestone Despite Market Doubts

Offchain Labs is actually doubling down on ARB like it's the last mochi ball at a dessert buffet.

The brains behind Arbitrum just announced they've been quietly stacking more ARB tokens under an approved purchase plan, and honestly? The timing is chef's kiss levels of contrarian. This is happening right when governance tokens across the industry are getting dumped faster than last season's NFT collections, and sentiment is more bearish than a hibernating grizzly.

So what's Arbitrum anyway? Think of it as Ethereum's speedy sidekick – a layer-2 scaling network that handles transactions off-chain using something called optimistic rollups (fancy tech speak for "we'll assume you're not lying unless proven otherwise"). The result? Faster transactions, lower fees, and all the security benefits of Ethereum without the wallet-draining gas costs.

But here's where it gets spicy: ARB is purely a governance token, meaning holders get voting rights but no direct revenue share. All that sweet network income? It flows to a treasury wallet controlled by tokenholders. It's like being a shareholder who votes on company decisions but doesn't get dividend checks.

The move is raising eyebrows because across crypto, core teams have been quietly yeeting their governance tokens like hot potatoes. Offchain Labs bucking this trend signals they're not just committed – they're ride-or-die for Arbitrum's future, even as competition from Optimism and Base heats up faster than a Twitter debate about token economics.

Offchain Labs purchased additional ARB tokens despite weak governance token market sentiment across cryptoArbitrum crossed $20B in total value secured and processed 2.1B+ lifetime transactions on Arbitrum OneMove signals long-term conviction while competitors like Optimism and Base battle for Ethereum's $68B DeFi market shareSolana and Ethereum Can Both Win the Blockchain Race According to Dragonfly VC

Rob Hadick from Dragonfly just dropped the most diplomatic take in crypto: Solana and Ethereum aren't locked in some Highlander-style "there can be only one" battle. Plot twist – they're both going to make it.

When CNBC asked Hadick the classic "which blockchain is Facebook and which is MySpace" question (because apparently we're still doing 2000s social media analogies), his answer was basically "they're both Facebook." Mic drop moment right there.

His logic? With tokenization gaining steam and more economic activity moving onchain, the market is way too big for just one blockchain to handle. It's like asking whether we need McDonald's OR Burger King – why not both when everyone's hungry?

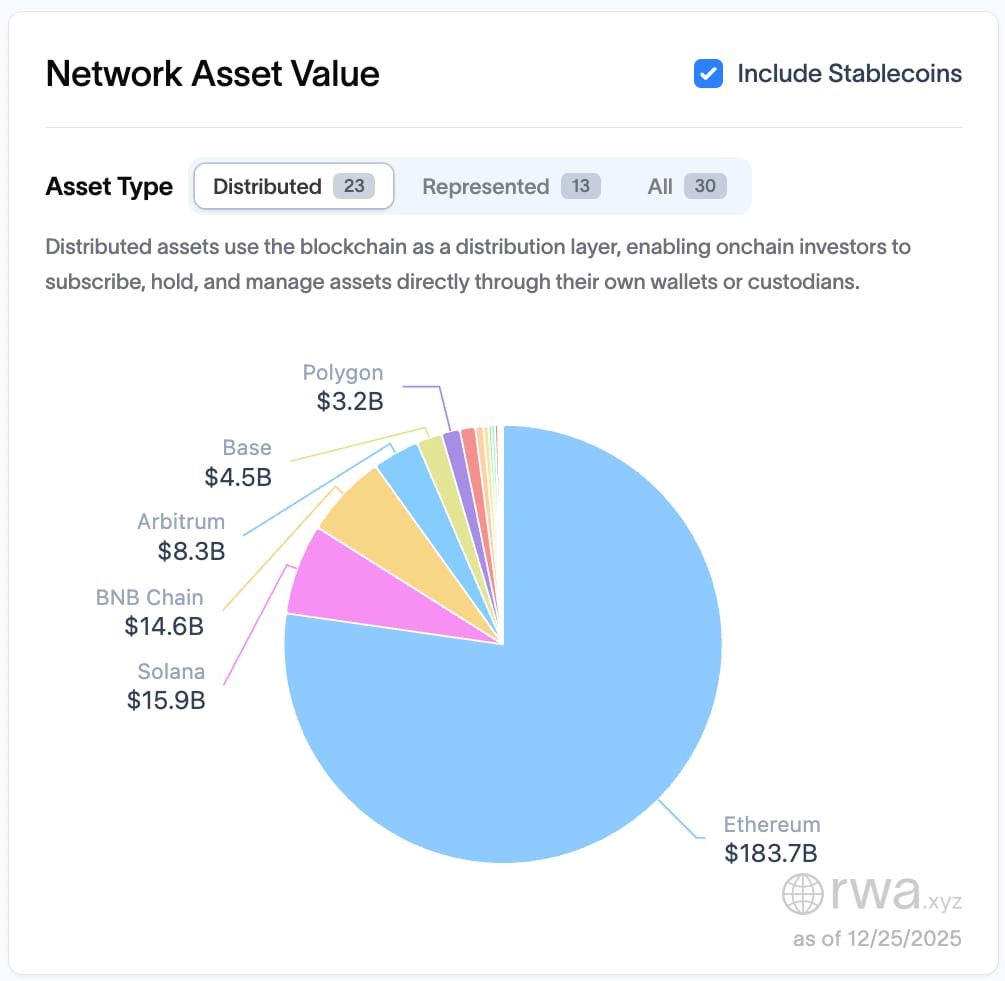

Ethereum has the largest network asset value among the blockchain networks. Source: RWA.XYZ

Here's the current scoreboard: Ethereum is absolutely dominating with $183.7 billion in network asset value (including stablecoins), while Solana sits at $15.9 billion. That's a pretty massive gap, folks. Ethereum is where most stablecoins live and where the bulk of onchain economic activity happens. But – and this is a big but – Solana handles the most trading volume and is "more optimized" for high-speed transactions.

Think of it this way: Ethereum is the reliable sedan with all the safety features, while Solana is the sports car that goes zoom-zoom. Different vibes, different use cases.

Even crypto platforms are playing the field. Fantasy sports platform Sorare just migrated from Ethereum to Solana after six years, chasing that sweet scalability and consumer-focused user base. And get this – Sorare's CEO still says he's "confident in Ethereum" even after bouncing. It's not personal, it's just blockchain business.

Both Solana and Ethereum will thrive in tokenization as market is too big for one blockchain to dominateEthereum leads with $183.7B in assets vs. Solana's $15.9B, but Solana handles more trading volumePlatforms like Sorare are switching chains based on specific needs, showing blockchains serve different use casesCrypto M&A Explodes to Record $8.6B in 2025 Thanks to Trump's Pro Crypto Policies

2025 just became the year crypto companies learned to swipe their corporate credit cards like there's no tomorrow. We're talking a whopping $8.6 billion in M&A deals, which is a nearly 300% jump from 2024's measly $2.17 billion. Somebody clearly spiked the punch at every boardroom meeting this year.

The Financial Times reports that 267 deals were signed through Tuesday, marking an 18% increase in deal count from last year. But it's not just quantity – the quality (and price tags) went stratospheric. Coinbase flexed the hardest with its record-breaking $2.9 billion acquisition of Deribit, the crypto options trading platform. That's officially the biggest crypto acquisition ever, making previous deals look like pocket change.

Executives from Bullish rang the opening bell on the exchange’s NYSE debut. Source: YouTube

Not to be outdone, Kraken dropped $1.5 billion on NinjaTrader (a futures trading platform), and Ripple splurged $1.25 billion on Hidden Road, a crypto-friendly prime broker. It's like watching a high-stakes poker game where everyone's all-in.

So what's fueling this acquisition addiction? Two words: President Trump. His administration has been rolling out crypto-friendly deregulation faster than you can say "diamond hands," including dropping regulatory lawsuits that had traditional finance firms sitting on the sidelines. Now those TradFi players are diving into crypto with their checkbooks open.

But wait, there's more! Crypto IPOs raised $14.6 billion globally from 11 offerings – a massive leap from last year's $310 million from just four IPOs. Bullish raised $1.1 billion, Circle pulled in over $1 billion, and Gemini secured $425 million. The capital markets are officially open for crypto business.

Legal experts are predicting this M&A frenzy will continue into 2026, especially as companies scramble for licenses under EU's MiCA laws and new US/UK stablecoin regulations.

Record $8.6B in crypto deals closed in 2025 (300% increase), led by Coinbase's $2.9B Deribit purchaseTrump's pro-crypto policies and deregulation gave traditional finance confidence to enter the space$14.6B raised from 11 crypto IPOs vs. $310M from 4 IPOs in 2024, with M&A expected to surge in 2026Nvidia Scoops Up Groq's AI Chip Technology in Reported $20B Mega Deal

Nvidia just made a galaxy-brain business play that's got the AI chip world spinning. The GPU giant struck a non-exclusive licensing deal with Groq, one of its main competitors in the AI chip space, and as a cherry on top, they're hiring Groq's founder Jonathan Ross, president Sunny Madra, and other key employees. Talk about a hostile takeover disguised as a handshake.

Now, here's where it gets juicy: CNBC reported the deal is worth $20 billion, which would make it Nvidia's largest acquisition ever. However, Nvidia is being coy about the details, clarifying this isn't technically an acquisition of the company but refusing to comment on the scope. Either way, someone's getting a very expensive Christmas present.

So why does Nvidia want Groq so badly? Because Groq isn't playing around with your standard chips. They've developed something called an LPU (language processing unit) – fancy tech that allegedly runs large language models 10 times faster while using one-tenth of the energy. That's like claiming your Honda Civic can outrace a Ferrari while sipping gas like a Prius. Bold claims, but coming from Jonathan Ross, they might actually hold water. This guy helped invent Google's TPU (tensor processing unit), so he's basically the chip whisperer.

Groq's been on a tear lately. They raised $750 million in September at a $6.9 billion valuation, and their tech now powers AI apps for over 2 million developers – up from just 356,000 last year. That's explosive growth that clearly caught Nvidia's attention.

With this move, Nvidia is basically eating the competition for breakfast and positioning itself to be even more dominant in the AI chip manufacturing game. If you can't beat 'em, buy 'em (or license their tech and poach their talent). Classic Silicon Valley chess move.

Nvidia licensed Groq's AI chip tech and hired founder Jonathan Ross in a deal reportedly worth $20BGroq's LPU claims 10x faster LLM performance at one-tenth the energy compared to traditional chipsGroq raised $750M at $6.9B valuation and powers 2M+ developers' AI apps, showing rapid growthDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). From layer-2 dominance to billion-dollar acquisitions, 2025 is shaping up to be an absolutely legendary year for crypto. Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #312

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -