- Proof Of Intel

- Posts

- Banks Flirt with Crypto, Connecticut Crashes the Party, Smartphone Chips Crack Wide Open, and Zuck's Soup-Fueled Design Heist!

Banks Flirt with Crypto, Connecticut Crashes the Party, Smartphone Chips Crack Wide Open, and Zuck's Soup-Fueled Design Heist!

In this edition, navigate the chaos of crypto collaboration and courtroom clashes, unfixable hardware nightmares, and Meta's talent raid on Apple – all the juicy details inside!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From major banks testing the crypto waters with Coinbase (while simultaneously throwing punches), to Connecticut crashing the prediction market party, a nightmare smartphone chip vulnerability that can't be patched, and Meta raiding Apple's design vault—we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets!

INTEL BRIEF

🟧 Major US banks are reportedly testing stablecoin and crypto-trading pilots with Coinbase, while BlackRock's CEO acknowledges Bitcoin's legitimacy—but the bank-crypto love affair might be more complicated than it seems.

🟧 Connecticut just told Robinhood, Crypto.com, and Kalshi to pump the brakes on their prediction markets, claiming they're running unlicensed sports betting operations—and Kalshi is already clapping back in federal court.

🟧 Ledger researchers discovered an unfixable vulnerability in a popular smartphone chip (used in devices like the Solana Seeker) that could let attackers gain total control and swipe private keys—and there's no patch coming.

🟧 Meta just snagged Apple's top design exec Alan Dye to lead a new creative studio in Reality Labs, signaling the company's serious push into AI-powered smart glasses and VR headsets.

Major Banks Are Testing Crypto With Coinbase While Also Fighting Them in Court

Traditional banks are finally sliding into crypto's DMs, and Coinbase is here for it. At The New York Times DealBook Summit, Coinbase CEO Brian Armstrong dropped some spicy intel: major US banks are running early-stage pilots involving stablecoins, crypto custody, and digital-asset trading with his exchange. Armstrong didn't name names (keeping it mysterious, we see you), but he did throw shade at the stragglers, warning that banks who sleep on crypto are going to get "left behind." Ouch.

Armstrong shared the stage with none other than BlackRock CEO Larry Fink, and surprisingly, these two found common ground on Bitcoin. Armstrong straight-up dismissed any doomsday scenario where Bitcoin crashes to zero, while Fink admitted he now sees a "significant use case" for the digital asset. That's quite the character development from the guy who once wasn't exactly Bitcoin's biggest cheerleader! Though Fink did caution that Bitcoin remains "heavily influenced by leveraged players," so don't go YOLO-ing your life savings just yet, folks.

Top Tokenized Treasury funds. Source: RWA.xyz

Speaking of BlackRock, their iShares Bitcoin Trust (IBIT) is absolutely crushing it—it's now the largest spot Bitcoin ETF with a market cap topping $72 billion. Plus, BlackRock's tokenized US Treasury product is managing around $2.3 billion in assets. Not too shabby for a traditional finance giant dipping its toes into Web3 waters.

But here's where things get messy. Despite Armstrong's optimistic pilot talk, banks and Coinbase have been throwing hands lately. The Banking Policy Institute (chaired by JPMorgan's Jamie Dimon, no less) warned Congress back in August that stablecoins could undermine the banking sector's credit model—basically arguing that if everyone shifts from bank deposits to stablecoins, lending gets more expensive and credit dries up.

The real beef? Banks are salty about what they see as a "loophole" in the GENIUS Act, which bans stablecoin issuers from offering yield but lets third parties like Coinbase do exactly that. Armstrong isn't backing down either—he told Fox Business that Coinbase wants to replace traditional banks with a "super app" offering credit cards, payments, and rewards, while calling out those pesky three percent credit card fees. Shots fired!

The Independent Community Bankers of America even pushed back against Coinbase's application for a national trust charter, claiming the crypto-custody model is "untested." Coinbase's Chief Legal Officer Paul Grewal clapped back on X, calling it "protectionism" disguised as consumer protection.

So yeah, banks and Coinbase might be running pilots together, but behind the scenes? It's giving frenemy energy.

Major US banks are testing stablecoin and crypto pilots with Coinbase, though specific banks weren't namedBlackRock's Larry Fink now sees Bitcoin as having a "significant use case," while their Bitcoin ETF holds over $72 billionDespite collaboration talks, banks are actively lobbying against Coinbase, worried about stablecoins threatening traditional banking models and pushing back on Coinbase's charter applicationConnecticut Tells Robinhood and Kalshi Their Prediction Markets Are Illegal Sports Betting

Connecticut just became the latest state to crash the prediction market party, and they're not here to play nice. The Connecticut Department of Consumer Protection sent cease and desist letters to Robinhood, Kalshi, and Crypto.com on Wednesday, accusing them of offering unlicensed sports betting through their event contracts. Yikes.

DCP Commissioner Bryan Cafferelli didn't mince words, stating that "none of these entities possess a license" to offer wagering in Connecticut. He also pointed out that even if they did have licenses, their contracts would still violate state laws—including allowing people under 21 to place bets. DCP Gaming Director Kris Gilman piled on, accusing the platforms of "deceptively advertising" their services as legal while operating outside Connecticut's regulatory framework, which he claimed poses "serious risks to consumers."

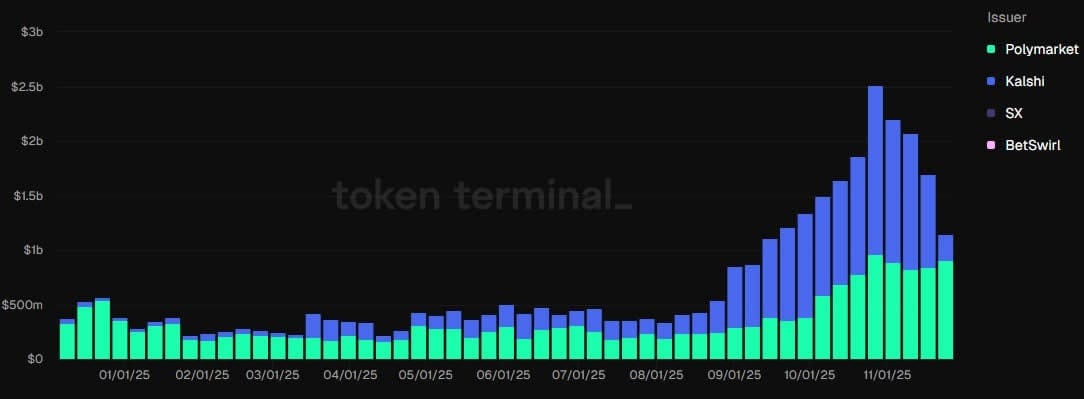

Prediction markets saw huge volumes in November. Source: Token Terminal

The state's beef with prediction markets isn't exactly new—these platforms have been under legal scrutiny across multiple US states as their popularity (and the billions of dollars flowing through them) has skyrocketed this year. Apparently, betting on everything from elections to celebrity drama has become too popular for regulators' comfort.

But Kalshi? They're not backing down. A spokesperson fired back, telling Cointelegraph that Kalshi is a "regulated, nationwide exchange" subject to exclusive federal jurisdiction. Translation: "Connecticut, you don't have the authority here." The company even filed a lawsuit on Wednesday against the DCP, arguing that Connecticut's attempt to regulate them "intrudes upon the federal regulatory framework" established by Congress. Kalshi insists its platform falls under the Commodity Futures Trading Commission's (CFTC) exclusive jurisdiction and that its sports event contracts are "lawful under federal law." Mic drop.

Robinhood echoed similar sentiments, with a spokesperson emphasizing that their event contracts are "federally regulated by the CFTC" and offered through Robinhood Derivatives, LLC, a CFTC-registered entity. They're basically saying, "We're compliant, regulated, and totally legit, Connecticut." Crypto.com, on the other hand, stayed suspiciously quiet—no comment at the time of reporting.

Connecticut's DCP didn't stop at just sending letters, though. They claimed prediction market platforms lack required technical standards, pose security risks for financial and personal data, don't have integrity controls to prevent insider betting or manipulation, and even advertise to self-excluded gamblers and on college campuses. Spicy allegations!

For context, Connecticut only recognizes three platforms as legally licensed for sports wagering: DraftKings, FanDuel, and Fanatics—all requiring users to be at least 21 years old.

And Connecticut isn't alone in its crackdown. Kalshi is currently battling regulators in at least 10 US states, including New York (which sent a cease and desist in late October), Massachusetts (where the attorney general sued in September), and Arizona, Illinois, Montana, and Ohio. The company is also tied up in ongoing litigation in New Jersey, Maryland, and Nevada. It's giving legal whack-a-mole vibes.

Despite all the drama, Kalshi just closed a $1 billion funding round at an $11 billion valuation this week, following its best-ever monthly volume in November. Clearly, investors are betting on them winning this legal showdown.

Connecticut issued cease and desist orders to Robinhood, Crypto.com, and Kalshi for allegedly offering unlicensed sports betting via event contractsKalshi fired back with a federal lawsuit, arguing it's under CFTC jurisdiction and lawful under federal law; Robinhood echoed similar defensesKalshi is facing legal battles in at least 10 US states but just raised $1 billion at an $11 billion valuation after record-breaking November volumeLedger Found a Chip Flaw That Could Let Hackers Steal Your Crypto and It Cannot Be Fixed

Ledger just dropped a bombshell report revealing that a chip widely used in smartphones—including the crypto-focused Solana Seeker—has an unfixable vulnerability that could allow attackers to gain complete control of your device and steal your private keys.

In a report released Wednesday, Ledger stated that its security engineers, Charles Christen and Léo Benito, successfully tested an attack on the MediaTek Dimensity 7300 (MT6878) chip. They managed to bypass all its security measures and achieve "full and absolute control" over the smartphone, with "no security barrier left standing." That's the kind of flex nobody wants to see from hackers.

So how'd they pull this off? The duo used electromagnetic pulses to take over the chip during its initial boot process. Since crypto wallets rely heavily on private keys (which some users store directly on their phones), bad actors could theoretically exploit this vulnerability to extract those keys and drain wallets faster than you can say "not your keys, not your crypto."

Christen and Benito were blunt in their assessment: "There is simply no way to safely store and use one's private keys on those devices." Ouch.

Ledger security engineers Charles Christen and Léo Benito used electromagnetic pulses to expose a vulnerability in MediaTek’s Dimensity 7300 chip. Source: Ledger

Now here's the really scary part: this vulnerability can't be fixed through a software update or patch. Why? Because the issue is literally coded into the silicon of the smartphone's system on chip (SOC). That means even if the vulnerability is disclosed publicly, users stay vulnerable. It's baked into the hardware, folks—no amount of updates will save you.

Before you panic completely, though, there's a small silver lining. The attack success rate is reportedly low—somewhere between 0.1% to 1%. But don't breathe that sigh of relief just yet. Christen and Benito explained that because the attack can be repeatedly attempted every second or so, an attacker could eventually gain access in "only a matter of a few minutes." They basically just keep rebooting the device, trying to inject the fault, and repeating the process until it works. Persistence pays off, apparently.

When Ledger reached out to MediaTek (the chipmaker), the company essentially said, "Yeah, that's not our problem." MediaTek told Ledger that electromagnetic fault injection attacks are "out of scope" for the MT6878 chip, explaining that the chip is designed for consumer products, not financial applications or Hardware Security Modules (HSMs). They added that the chip isn't "specifically hardened" against these kinds of physical attacks and suggested that products with higher security requirements (like hardware crypto wallets) should be designed with appropriate countermeasures from the jump.

So, in other words: "We made a chip for regular phones, not Fort Knox. If you're storing crypto on it, that's kinda on you."

For the record, Christen and Benito began working on this experiment back in February and successfully exploited the vulnerability in early May. They disclosed the issue to MediaTek's security team, who reportedly informed all affected vendors. Cointelegraph has reached out to MediaTek for additional comment, but as of now, it's radio silence.

The takeaway? If you're storing significant crypto on your smartphone—especially one with this chip—you might want to reconsider your security setup. Hardware wallets exist for a reason, people!

Ledger discovered an unfixable vulnerability in the MediaTek Dimensity 7300 chip (used in Solana Seeker and other phones) that lets attackers gain total control via electromagnetic pulsesThe flaw is baked into the silicon and can't be patched; attackers could repeatedly attempt exploits and succeed in "a matter of minutes"MediaTek says the chip wasn't designed for finance apps, and products needing high security should have countermeasures—basically, don't store your keys on these phonesMeta Poached Apple's Design Chief to Lead a New Creative Studio for AI Glasses

Meta just poached one of Apple's most important design executives—and this isn't just any designer. Alan Dye, who led Apple's user interface team for the past decade, is reportedly leaving the tech giant to join Meta, according to Bloomberg's Mark Gurman. That's a big deal, folks.

This is being viewed as a significant hire for Meta, especially as the company doubles down on consumer devices like smart glasses and virtual reality headsets. Dye will be laser-focused on improving AI features in these devices and will report directly to Meta's Chief Technology Officer, Andrew Bosworth. Translation: Meta is getting serious about competing in the AI hardware race, and they want Apple-level polish on their products.

Over at Apple, Dye will be replaced by Steve Lemay, who Tim Cook himself praised for having played a "key role in the design of every major Apple interface since 1999." So yeah, Apple's replacing a legend with another legend—but losing Dye still stings.

It seems Meta has been on a recruitment spree lately, cherry-picking talent from its competitors to fuel its AI ambitions. The company also poached researchers from OpenAI this summer, and here's where things get absolutely hilarious: Meta CEO Mark Zuckerberg allegedly hand-delivered homemade soup to an OpenAI employee as part of his recruitment pitch. Yes, you read that right—soup.

OpenAI's chief research officer Mark Chen confirmed the story and said he's since started delivering his own soup to promising Meta recruits in retaliation. Honestly, if the AI wars are being fought with homemade soup, sign us up for the tastiest timeline.

Shortly after news broke of Dye's departure, Zuckerberg announced a new creative studio within Reality Labs that Dye will lead. He won't be working alone, either. Joining him will be Billy Sorrentino (another former Apple designer who led interface design across Reality Labs), Joshua To (who also led interface design at Reality Labs), Meta's industrial design team led by Pete Bristol, and its metaverse design and art teams led by Jason Rubin. That's a stacked roster of design talent.

Zuckerberg described the studio's mission as bringing together "design, fashion, and technology" to define the next generation of Meta's products and experiences. On Threads, he elaborated: "Our idea is to treat intelligence as a new design material and imagine what becomes possible when it is abundant, capable, and human-centered." He also emphasized plans to "elevate design within Meta" and assemble a talented group with a mix of craft, creative vision, systems thinking, and deep experience building iconic products that bridge hardware and software.

In other words, Meta wants to make sure its AI-powered glasses and VR headsets don't just work well—they need to look good and feel intuitive, Apple-style. And who better to lead that charge than someone who spent a decade making Apple's interfaces some of the most beloved in tech?

It's clear Meta is betting big on the future of wearable AI devices, and they're not messing around when it comes to talent acquisition. Whether it's through strategic hires or soup diplomacy, Zuckerberg is making moves.

Meta hired Alan Dye, Apple's design exec who led UI design for 10 years, to lead a new creative studio in Reality Labs focused on AI-powered devicesZuckerberg announced the studio will combine design, fashion, and tech to define Meta's next-gen products, with Dye reporting to CTO Andrew BosworthMeta's been on a recruitment spree from competitors like Apple and OpenAI—allegedly including Zuckerberg hand-delivering homemade soup to woo talent (yes, really)Do you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit smarter about where not to store your private keys. Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #302

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -