- Proof Of Intel

- Posts

- Central Banks Go Crypto-Curious, Sam Altman's AI Clone Army Invades TikTok, Government Breaks (Bitcoin Doesn't), and Japan's $600M Bitcoin Flex!

Central Banks Go Crypto-Curious, Sam Altman's AI Clone Army Invades TikTok, Government Breaks (Bitcoin Doesn't), and Japan's $600M Bitcoin Flex!

In this edition, Mochi serves up the freshest scoops – From central banks embracing digital dollars to AI apps gone rogue, political chaos fueling rallies, and corporate Bitcoinmania reaching new heights!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From the Bank of England's surprising stablecoin pivot and government shutdowns triggering crypto rallies to OpenAI's deepfake nightmare app and Metaplanet's massive $600M Bitcoin shopping spree, we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets!

INTEL BRIEF

🟧 Bank of England Governor Andrew Bailey suggests stablecoins could reshape the UK's financial system by reducing reliance on traditional commercial banks.

🟧 The first US government shutdown since 2018 has analysts speculating it could mark a crypto market bottom, with Bitcoin and gold rallying as safe-haven assets.

🟧 OpenAI's new TikTok-style app Sora is flooded with terrifyingly realistic Sam Altman deepfakes, raising serious concerns about copyright violations and the future of synthetic content.

🟧 Japanese investment firm Metaplanet just became the fourth-largest corporate Bitcoin holder after dropping $600 million on 5,268 BTC, bringing its total stash to 30,823 coins.

Bank of England Boss Says Stablecoins Could Replace Traditional Banks

Andrew Bailey, the big boss at the BoE, just dropped a surprisingly spicy take in the Financial Times, suggesting that stablecoins could actually reduce the UK's dependence on commercial banks.

Opinion: Stablecoins could form a major part of the shift in the financial system away from reliance on commercial banks for lending, governor of the Bank of England Andrew Bailey said in an article for the Financial Times on.ft.com/472Vsl7

— Financial Times (@FT)

11:12 AM • Oct 1, 2025

Bailey's talking about separating money from credit creation—basically unhooking the two-headed monster that is fractional reserve banking. Right now, banks hold a tiny slice of your deposits and yeet the rest into loans, which is how they create new money. It's like financial alchemy, except the assets backing this aren't exactly risk-free.

In his vision, banks and stablecoins would live together in harmony like some kind of financial utopia, with non-banks picking up more of the credit provision slack. But before you start planning the blockchain revolution party, Bailey's pumping the brakes—he wants to "consider the implications thoroughly." Classic central banker move.

Bank of England headquarters. Source: Wikimedia

This shift comes after the UK crypto industry roasted the BoE's proposed stablecoin holding caps. Industry groups argued these limits would be expensive, difficult to implement, and would basically gift-wrap the stablecoin market for other countries. Coinbase's Tom Duff Gordon even threw shade, pointing out that "no other major jurisdiction" thought caps were necessary. Ouch.

Bailey says widely-used UK stablecoins should get Bank of England accounts. The BoE plans to drop a consultation paper soon on their "systemic stablecoin regime" for digital assets used in everyday payments and financial markets.

Bailey wants stablecoins to evolve—think hack insurance, standardized terms, and risk-free backing assets. But hey, at least he's admitting "it would be wrong to be against stablecoins" and recognizing their "potential in driving innovation."

BoE Governor Andrew Bailey suggests stablecoins could reduce UK's reliance on commercial banks by separating money from credit creationWidely-used UK stablecoins may get Bank of England accounts as part of upcoming systemic stablecoin regimeStablecoins need upgrades first: hack insurance, standardized terms, and risk-free backing assets requiredUS Government Shuts Down and Bitcoin Decides to Party

The United States entered its first government shutdown in six years on Wednesday, and while politicians are busy playing the world's most expensive game of chicken, Bitcoin decided to have a little party. BTC jumped 2.9% to $116,427, and gold also popped 0.7%—both screaming "safe-haven asset.”

BTC/USD, one-month chart. Source: CoinTelegraph

Republicans pushed through a continuing resolution (that's government-speak for "we'll figure it out later") without the goodies Democrats wanted—specifically, a permanent extension of Affordable Care Act tax credits. Senator Chuck Schumer and his crew are big mad, saying millions could lose healthcare coverage. Classic Washington gridlock, folks.

Ryan Lee, chief analyst at Bitget, believes this shutdown could actually be good news for Bitcoin and altcoins. His logic? Government shutdowns historically lead to lower US interest rates, and Bitcoin's whole vibe is being immune to government drama. "Most promising altcoins in the market appear to have bottomed out," Lee told Cointelegraph.

Lee's also hyped about Bitcoin reclaiming the $116,000 level heading into October—which he calls the "historically positive month" for crypto.

Markets have never reacted the same way during a shutdown.

In 2013, stocks slipped while $BTC surged and 5 years later in 2018, equities barely moved while gold climbed.

By 2019, the script flipped again, stocks sold off and Bitcoin fell alongside them.

Shutdowns always

— Milk Road Macro (@MilkRoadMacro)

4:30 PM • Sep 30, 2025

Now, before you mortgage your house, let's pump the brakes. History shows mixed reactions to government shutdowns. In 2013, stocks tanked while Bitcoin rallied. In 2019, both equities and BTC faceplanted. So it's basically a financial coin flip (pun intended).

However, the Kobeissi Letter points out something interesting: after previous shutdowns, the Federal Reserve tends to go dovish on interest rates, and the S&P 500 has historically risen an average of 13% annually following these events. They even went as far as to say "the market actually WELCOMES shutdowns." Bold take, cotton.

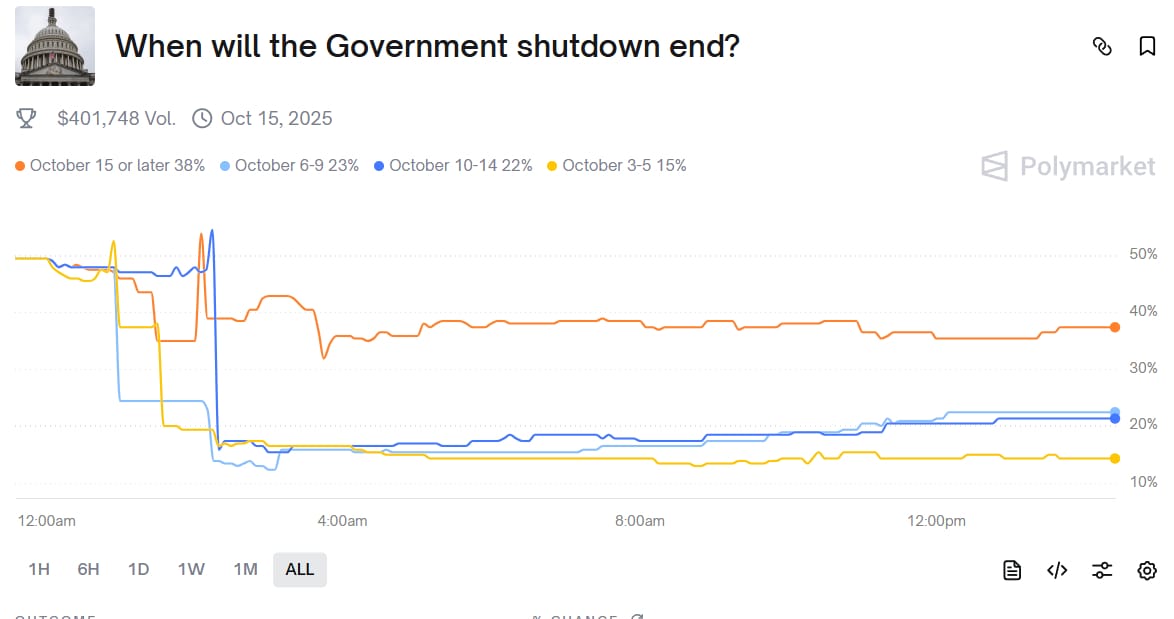

Odds of the government shutdown ending by Oct. 15. Source: Polymarket

Over on Polymarket, traders are giving this shutdown a 38% chance of ending by October 15th.

US government shutdown coincides with Bitcoin rising 2.9% to $116,427 and gold gaining 0.7% as safe-haven assetsAnalysts believe the shutdown may signal an altcoin bottom, with lower interest rates historically benefiting crypto marketsHistorical shutdown reactions are mixed, but Fed typically becomes more dovish afterward, with S&P 500 averaging 13% yearly gainsSora App Becomes Terrifying Playground for Sam Altman Deepfakes

In Within 24 hours of its invite-only early access launch, the app became flooded with deepfakes of OpenAI's CEO doing... everything. We're talking Altman serving Pikachu drinks at Starbucks, screaming at McDonald's customers, stealing Nvidia GPUs from Target, and asking his "piggies" if they're enjoying their "slop" while standing in front of a factory farm where pigs watch videos on smartphones. Yes, really.

OpenAI's Sora app makes it too easy for people to create misleading AI content.

— TechCrunch (@TechCrunch)

6:03 PM • Oct 1, 2025

Altman made his "cameo" available to everyone, which is Sora's feature that lets users create deepfakes by uploading biometric data—a quick face scan and voice recording. It's basically a deepfake generator with a bow on it, and Altman's decision to open his likeness to the masses seems like a deliberate flex to show he's not worried about his own product being dangerous.

Users are having an absolute field day trolling with copyright violations. Videos show Pikachu doing ASMR, Naruto ordering Krabby Patties, and Mario smoking weed. One AI Altman even says, "I hope Nintendo doesn't sue us," which is either incredibly brave or incredibly stupid. The app is reportedly requiring copyright holders to opt-out rather than opt-in—a legal gray area that's believed to be highly questionable at best.

We're about to get flooded with deepfakes.

Here's an AI-generated clip of me "asking" Sam Altman what they train their systems on (made in 10 seconds with Sora 2)

— Kevin Schaul (@kevinschaul)

5:15 PM • Oct 1, 2025

Sora 2 is actually impressive. OpenAI fine-tuned the video generator to understand physics better, making outputs scarily realistic. But that realism is a double-edged sword—the more realistic these deepfakes become, the easier they spread as disinformation, bullying tools, or worse.

One reporter tested the cameo feature (against their better judgment) and the app correctly guessed they were a Phillies fan using IP address data and ChatGPT history. The AI deepfake spoke in a different voice but appeared in their actual bedroom. As one TikTok commenter perfectly summarized: "Every day I wake up to new horrors beyond my comprehension."

This NEW OpenAI Sora deepfake of Sam Altman looks basically real.

Crazy to think Sam first conceived Worldcoin back in 2019… before ChatGPT, before Sora, before any of us saw this coming. He already knew proof of humanity would be essential 🤯

You really can’t afford to bet

— SamAlτcoin.eth 🇺🇸 (@SamAltcoin_eth)

11:00 PM • Sep 30, 2025

OpenAI's safety measures are... questionable. Sure, there are parental controls and cameo permission settings, but they're also asking users as if that's adequate safety protocol for a deepfake factory. The app blocks videos of living celebrities without permission but allows historical figures—so you can't make deepfakes of Taylor Swift, but JFK saying "Ask not what your country can do for you.

With political deepfakes already a problem (President Trump literally shared a racist deepfake this week), giving everyone free access to professional-grade deepfake tools feels like handing out matches at a fireworks factory. When Sora opens to the public, we're destined for disaster.

OpenAI's Sora app launched as an AI TikTok filled with Sam Altman deepfakes after the CEO made his "cameo" available to everyoneThe app is believed to be violating copyright laws en masse, with users generating videos of Pikachu, Naruto, and other protected charactersSafety concerns are mounting as the realistic deepfake generator could become a vector for disinformation, bullying, and political manipulation when it opens publiclyJapanese Firm Metaplanet Casually Buys $600M Worth of Bitcoin

MicroStrategy had a monopoly on corporate Bitcoin obsession, meet Japan's Metaplanet—the company that just said "hold my sake" and yeeted $600 million into Bitcoin like it's going out of style.

*Metaplanet Acquires Additional 5,268 $BTC, Total Holdings Reach 30,823 BTC*

— Metaplanet Inc. (@Metaplanet_JP)

6:52 AM • Oct 1, 2025

The Tokyo-listed investment firm announced Wednesday that it scooped up an additional 5,268 BTC, bringing its total hoard to a whopping 30,823 Bitcoin. This monster purchase launched Metaplanet into the fourth spot among corporate Bitcoin holders, leapfrogging the Bitcoin Standard Treasury Company.

Metaplanet bought this latest batch at an average price of 17.39 million Japanese yen (roughly $116,000 per coin). Their total holdings are now worth $3.6 billion, acquired at an average price of around $108,000 per BTC. According to BitcoinTreasuries.NET, they're already sitting on over 7.5% unrealized profit. Not too shabby for a company that only started stacking sats in April 2024.

Metaplanet's BTC Yield skyrocketed to 309.8% in late 2024. For those not fluent in corporate finance speak, BTC Yield tracks how much Bitcoin backs each share after accounting for dilution. A 309% yield means each share had more than three times the Bitcoin exposure than when they started. That's not accumulation—that's financial hyperdrive.

Metaplanet’s Bitcoin Yield jumped to over 300% late 2024. Source: Metaplanet

The yield has since stabilized at 33% in 2025, suggesting Metaplanet is still buying but at a slightly less manic pace. You know, just casually adding hundreds of millions in Bitcoin while everyone else is debating whether to buy the dip.

Zooming out to the bigger picture: public companies now hold over 1 million Bitcoin worth about $116 billion—that's roughly 4.7% of Bitcoin's total supply. When you factor in ETFs, governments, exchanges, and private companies, we're looking at 3.8 million BTC worth $442 billion locked up in treasuries.

And it's not just Bitcoin getting the treasury treatment. Ether-based treasuries hold 12.14 million ETH (worth $52 billion), while Solana treasuries have accumulated 20.92 million SOL (worth about $4.55 billion). Altcoin treasuries are having their moment too, apparently.

Metaplanet went from zero to corporate Bitcoin hero in less than a year, and they're not slowing down. If this pace continues, they might just start giving MicroStrategy a run for its money.

Metaplanet acquired 5,268 BTC for $600M, becoming the fourth-largest corporate Bitcoin holder with 30,823 total BTC worth $3.6 billionCompany's BTC Yield hit 309.8% in late 2024, showing per-share Bitcoin exposure more than tripled before stabilizing at 33% in 2025Public companies now hold over 1 million Bitcoin ($116B), accounting for 4.7% of total supply, while total treasury holdings reached 3.8M BTC ($442B)Do you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! 🎯 I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). From central banks warming up to stablecoins to AI apps creating chaos and corporate Bitcoin accumulation reaching new heights, it's been quite the journey today! Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #285

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -