- Proof Of Intel

- Posts

- Crypto Billionaires Flee California, Flow Blockchain Implodes, Hackers Gift Players $13M, and Bitcoin Saves the Dollar?!

Crypto Billionaires Flee California, Flow Blockchain Implodes, Hackers Gift Players $13M, and Bitcoin Saves the Dollar?!

From tax revolts to blockchain disasters, gaming hacks to crypto's surprising role in saving the dollar – all the juicy details inside!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From California's billionaire tax throwing crypto execs into a frenzy and Flow's blockchain rollback disaster to Ubisoft's $13.3 million hack giveaway and Coinbase's CEO defending Bitcoin as the dollar's unlikely wingman, we've got a LOT to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets, gaming chaos, and policy drama!

INTEL BRIEF

🟧 Crypto executives are slamming California's proposed 5% billionaire wealth tax, arguing it'll trigger a mass exodus of entrepreneurs and their capital from the Golden State.

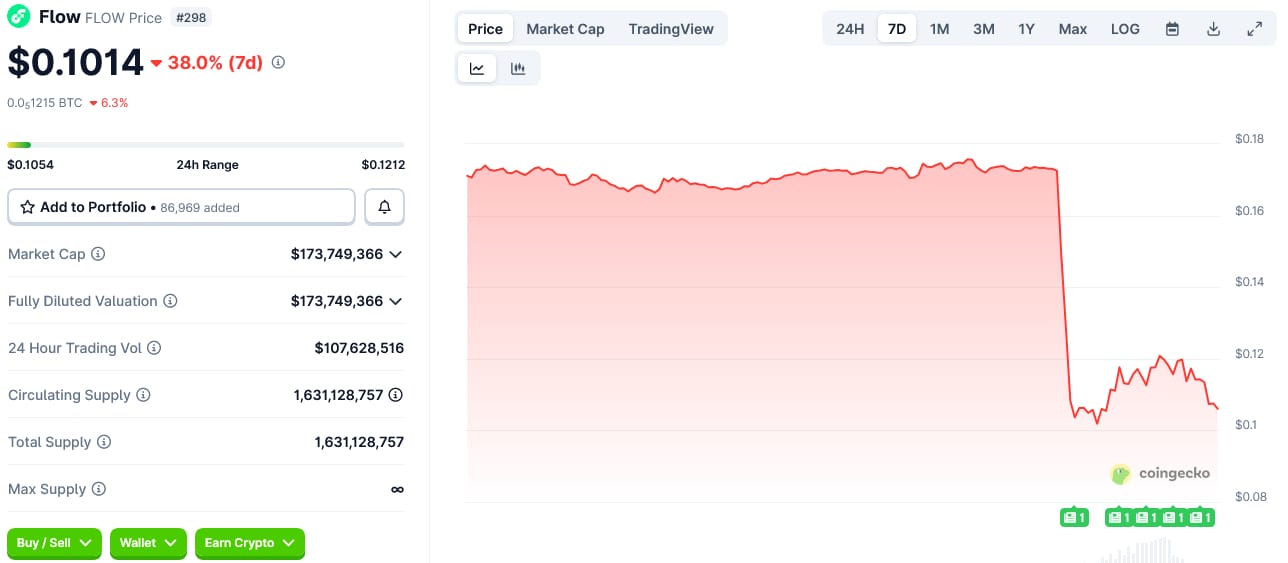

🟧 Flow Foundation's plan to roll back its blockchain after a $3.9 million exploit has sparked industry outrage, with validators urged to halt operations and the FLOW token tanking 42%.

🟧 Ubisoft was forced to shut down Rainbow Six Siege after hackers hijacked the servers and gifted every player $13.3 million worth of in-game credits, triggering a massive rollback.

🟧 Coinbase CEO Brian Armstrong argues that Bitcoin acts as a "check and balance" on the US dollar, pressuring policymakers to maintain fiscal discipline and paradoxically helping preserve America's reserve currency status.

Crypto Executives Threaten to Leave California Over Proposed Billionaire Wealth Tax

California. Just when we thought you couldn't get any spicier with your policy proposals, here comes the 2026 Billionaire Tax Act – and crypto's finest are NOT having it.

The proposed measure would slap a 5% tax on net wealth above $1 billion, with funds supposedly earmarked for healthcare and state assistance programs (because nothing says "help" like making rich people really, really angry). But here's where it gets interesting: this tax would hit unrealized gains too, meaning some billionaires might need to sell off stock or chunks of their businesses just to cut Uncle California a check. Talk about awkward.

Crypto heavyweights are already sharpening their pitchforks. Kraken co-founder Jesse Powell didn't mince words, promising this would be "the final straw" that sends billionaires packing – along with their spending, philanthropy, and job creation. Bitwise CEO Hunter Horsley pointed to a damning December audit showing California's questionable track record with taxpayer funds, calling the new tax a "private citizen asset confiscation." Yikes.

Even Castle Island Ventures' Nic Carter chimed in, questioning whether anyone bothered analyzing capital mobility (spoiler: capital is more mobile than ever). He's speculated that wealth taxes signal to the wealthy that more taxes are coming, like a sovereign default but with better weather.

Meanwhile, US Representative Ro Khanna, a crypto-friendly Democrat, is defending the measure, arguing it'll fund childcare, housing, and education – you know, the good stuff that makes innovation possible.

But Dune CEO Fredrik Haga brought the receipts from Norway, where a similar tax reportedly sent half of the top 400 taxpayers' wealth abroad, making everyone "more equal and poorer." So, you know, maybe not the win California's hoping for?

The verdict? This proposal is believed to be dead on arrival in Crypto Twitter's court of public opinion.

California's proposed 5% billionaire wealth tax (including unrealized gains) has crypto execs predicting a mass exodus of entrepreneurs and capitalCritics point to Norway's failed experiment with wealth taxes and California's questionable spending track record as red flagsRep. Ro Khanna defends the measure, arguing it'll fund programs that boost innovation, but crypto leaders aren't buying itFlow Foundation's Rollback Disaster Leaves Blockchain Frozen and Token Crashing

Flow Foundation, we need to talk. When you're dealing with a $3.9 million exploit, the last thing you want to do is make the situation exponentially worse – but that's allegedly exactly what happened here.

Let's rewind (pun absolutely intended). On December 27th, an attacker exploited a flaw in Flow's execution layer and yeeted funds off the chain via multiple cross-chain bridges. Not great! Flow Foundation's brilliant solution? Roll back the entire blockchain. You know, that thing that's supposed to be immutable and decentralized? Yeah, let's just... undo some of that.

deBridge founder Alex Smirnov was NOT amused. He's urged Flow validators to stop processing transactions until there's a proper remediation plan, especially for users who bridged out during the rollback window (who now face doubled balances – talk about confusing). The Flow blockchain has been stuck at block height 137,385,824 since Saturday night, frozen like a blockchain popsicle.

The FLOW token didn't take the news well either, plummeting 42% since the attack. Ouch.

But wait – plot twist! On October 29th (yes, the date seems off, but that's what the article says), Flow Foundation announced a "revised remediation plan" with NO network rollback, preserving all legitimate user activity. Dapper Labs, Flow's creator, backed the new approach. Crisis averted? Maybe?

FLOW’s change in price over the last week. Source: CoinGecko

Critics aren't letting Flow off easy though. Gabriel Shapiro from Delphi Labs slammed the approach, arguing Flow is "creating unbacked assets" and expecting bridges to take the hit. Smirnov pointed out that rollbacks create "systemic issues" affecting bridges, custodians, and exchanges – potentially causing more financial damage than the original exploit.

For context, Flow was launched by Dapper Labs in 2020 with a whopping $725 million in funding from heavyweight VCs like a16z. But the blockchain has arguably fallen short of expectations, with just $85.5 million in total value locked and FLOW languishing outside the top 300 tokens by market cap.

The takeaway? This is believed to be a masterclass in how NOT to handle a security incident.

Flow Foundation's planned blockchain rollback after a $3.9 million exploit sparked massive backlash from ecosystem partnersdeBridge's founder urged validators to halt operations, while FLOW token crashed 42% and the chain remained frozenFlow later announced a revised plan with no rollback, but damage to confidence in the network's decentralization and security is speculated to be doneUbisoft Shuts Down Rainbow Six Siege After Hackers Gift Players Millions in Credits

hackers decide to play Santa Claus and hand out $13.3 million worth of in-game currency to every single player. Welcome to the Rainbow Six Siege chaos of December 2024, folks.

French gaming titan Ubisoft had to slam the emergency brake on Rainbow Six Siege after hackers pulled off what can only be described as the most generous (and illegal) giveaway ever. Every player who logged in found themselves suddenly 2 billion R6 credits richer, along with rare skins and guns. To put that in perspective, you'd normally have to drop $13.33 million in real money to accumulate that many credits. Talk about a payday!

But wait, it gets better (or worse, depending on your perspective). The hackers didn't just stop at currency – they allegedly took control of the game's messaging and banning systems too, essentially turning Rainbow Six Siege into their personal playground. Screenshots shared by players show the extent of the takeover, and let's just say it was NOT what Ubisoft had on its December roadmap.

The Rainbow Six Siege team confirmed the exploit on December 27th via X (formerly Twitter), and by the next day, they'd suspended the game's servers and marketplace entirely. Their solution? A massive rollback of all in-game credits received after 11 AM UTC. The team emphasized they're handling the situation with "extreme care" and promised no bans for players who spent their ill-gotten gains (because hey, not your fault hackers made you a virtual millionaire).

As of now, the game is in a soft-launch phase with a small number of test players as Ubisoft conducts "extensive quality control tests" to ensure everything's back to normal. Rainbow Six Siege boasts over 34,000 daily active players in December, so this shutdown is believed to be a pretty big deal for the community.

Here's the kicker: Ubisoft's ability to reverse these transactions highlights the centralized nature of traditional gaming economies. As the article notes, this wouldn't be possible with genuinely decentralized cryptocurrencies like Bitcoin or Ether (though Flow's recent rollback drama proves even crypto isn't immune to controversy).

Fun fact: Ubisoft has been dabbling in blockchain gaming, partnering with Immutable earlier this year for Web3 games like Might & Magic. Maybe they're learning some lessons about security right about now?

Hackers breached Rainbow Six Siege servers and gave every player 2 billion R6 credits (worth roughly $13.3 million), plus rare itemsUbisoft shut down the game and initiated a massive rollback of all credits received after the breach, with no player bans for spendingUbisoft shut down the game and initiated a massive rollback of all credits received after the breach, with no player bans for spendingCoinbase CEO Claims Bitcoin Acts as a Safety Check on US Dollar Dominance

Bitcoin, the rebellious digital currency that was supposed to overthrow traditional finance, might actually be helping the US dollar maintain its crown. At least, that's what Coinbase CEO Brian Armstrong is arguing, and honestly? It's kind of brilliant.

In a recent interview on Tetragrammation with Rick Rubin, Armstrong dropped this fascinating take: Bitcoin provides "healthy competition" for the dollar by acting as a market check on excessive inflation and deficit spending. Translation? When the Federal Reserve gets a little too trigger-happy with the money printer, people can flee to Bitcoin – and that threat alone keeps policymakers honest.

"If there's too much deficit spending or inflation in the US, people will flee to Bitcoin in times of uncertainty," Armstrong explained. He pointed out that 2-3% inflation is fine when the economy's growing at the same rate, but if inflation outstrips growth? Say goodbye to that reserve currency status, which would be a "massive blow to the United States."

Armstrong's conclusion? Bitcoin is believed to be "helping extend the American experiment" by ensuring financial regulators don't take actions that could undermine confidence in the US economy. Who knew digital gold could be such a patriot?

Now, let's talk about why this matters. America's national debt has ballooned to $37.65 trillion and is reportedly growing at $6 billion per day (or $70,843 per second if you want nightmares). Back in October, JPMorgan touted Bitcoin and gold as the "debasement trade" amid dollar uncertainty. Bitcoin hit a high of $126,080 on October 10th but has since pulled back 30% to $88,210, while gold continues its rampage, hitting $4,545 per ounce on Friday.

The Trump administration signed an executive order in March establishing a Strategic Bitcoin Reserve – though it's currently just stockpiling seized Bitcoin without purchasing any. The Bitcoin Act of 2025 is still crawling through Congress like a sloth on sedatives.

But hold up – some industry experts argue that stablecoins might be doing even more heavy lifting for dollar dominance. Polygon Foundation CEO Sandeep Nailwal called it "Dollarisation 2.0," claiming stablecoins are pushing USD into hands worldwide from LatAm to Africa. The US passed the GENIUS Act in mid-July for stablecoin regulation, and the market currently sits at $312.6 billion – with the Treasury estimating it'll hit $2 trillion by 2028.

The verdict? Bitcoin and stablecoins might just be the dollar's weirdest power couple.

Coinbase CEO Brian Armstrong argues Bitcoin acts as a check on US fiscal policy, pressuring the Fed to maintain discipline and paradoxically helping preserve USD's reserve statusUS national debt is growing at $6 billion per day to $37.65 trillion, while Bitcoin has retraced 30% from its $126,080 highSome experts believe stablecoins (currently a $312.6B market) may play an even bigger role in cementing dollar dominance globallyDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit wiser about the absolute chaos happening in crypto and gaming right now. Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #313

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -