- Proof Of Intel

- Posts

- Czech Crypto Criminal's Rooftop Escape, Winklevoss Twins' IPO Dreams, SEC's Retail Revolution, and Ronin's Ethereum Return!

Czech Crypto Criminal's Rooftop Escape, Winklevoss Twins' IPO Dreams, SEC's Retail Revolution, and Ronin's Ethereum Return!

In this edition, Mochi serves up darknet drama with $45M Bitcoin bribes, billion-dollar IPO ambitions despite massive losses, Wall Street's crypto courtship, and gaming blockchain homecomings – all the spicy details inside!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From Czech darknet drama with rooftop escape attempts and the Winklevoss twins' IPO ambitions to SEC's retail investor revolution and Ronin's Ethereum homecoming, we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets!

INTEL BRIEF

🟧 Czech police arrested darknet marketplace founder Tomas Jirikovsky in connection with a $45 million Bitcoin donation scandal that led to Justice Minister Pavel Blazek's resignation.

🟧 Crypto exchange Gemini, founded by the Winklevoss twins, filed for IPO on Nasdaq despite reporting widening losses of $282.5 million in the first half of 2025.

🟧 SEC Chair Paul Atkins hinted at expanding retail investor access to private equity investments, following Trump's executive order allowing crypto and alternative assets in 401K accounts.

🟧 Ronin network, creator of Axie Infinity, announced it will migrate back to Ethereum as a layer-2 solution by Q2 2026, citing improved performance and Wall Street's growing interest in ETH.

Czech Darknet Founder Gets Arrested After Epic Rooftop Escape Fail

Czech police have officially arrested darknet marketplace founder Tomas Jirikovsky in what can only be described as the most expensive political donation scandal in crypto history. And yes, he literally tried to escape by climbing onto his roof like some sort of Bitcoin-powered Spider-Man.

Policie včera večer za dramatických okolností zasahovala v břeclavském domě, kde přebývá dárce miliardy v bitcoinech Tomáš Jiřikovský. Muž, kterého vyšetřovatelé podezírají z nedovolené výroby a jiného nakládání s drogami, během razie unikl na střechu domu. Posléze jej policisté

— Deník N (@enkocz)

6:43 AM • Aug 15, 2025

The mastermind behind the now-defunct Sheep Marketplace – allegedly threw a casual 468 BTC (worth around $45 million at the time) at former Justice Minister Pavel Blazek in what authorities are calling a rather expensive "please don't send me back to prison" gift. Spoiler alert: it didn't work, and Blazek ended up resigning anyway.

⚖️🇨🇿 Ministr spravedlnosti Pavel Blažek převzal miliardu v bitcoinech z webu, na němž zločinci prodávali prudké jedy, drogy a zbraně.

🔎 Seznam Zprávy to zjistily analýzou archivů internetového tržiště Nucleus. Za jeho provoz dodnes nebyl postižen nikdo.— Seznam Zprávy (@SeznamZpravy)

8:15 AM • Jun 7, 2025

The arrest came after a Thursday night raid that turned into neighborhood entertainment when Jirikovsky decided his roof was the perfect hiding spot. His ex-wife reportedly got tipped off by a neighbor who was probably wondering why there was suddenly a darknet entrepreneur doing parkour above their heads. Czech police weren't impressed by the acrobatics and promptly secured their target.

Tomas Jirikovsky before the High Court in Olomouc in May 2018. Source: Seznam Zpravy

For context, this isn't Jirikovsky's first rodeo with controversy. The programmer built his crypto fortune by operating Sheep Marketplace – a delightful little corner of the internet specializing in drug trafficking, weapons sales, and counterfeit goods. When that party ended in 2013, he allegedly stole an additional 841 BTC from users.

The ongoing investigation continues to unravel connections between Jirikovsky and other darknet operations, proving that blockchain's transparency makes every transaction a permanent receipt. As one analyst noted, "Bitcoin isn't great for moving money quietly" – a lesson our rooftop runner learned the hard way!

Czech police arrested darknet founder Tomas Jirikovsky after he tried escaping via rooftop during a raidHe's accused of donating 468 BTC ($45M) to former Justice Minister Pavel Blazek to avoid prisonThe scandal led to Blazek's resignation and highlights Bitcoin's permanent transaction trailsWinklevoss Twins Take Gemini Public Despite Burning Through Millions

The Winklevoss twins – yes, those twins who famously tangled with Mark Zuckerberg over Facebook – are taking their crypto baby Gemini public on the Nasdaq Global Select Market under the ticker GEMI.

Another crypto company is headed for the public markets.

— TechCrunch (@TechCrunch)

12:22 AM • Aug 16, 2025

Gemini Space Station Inc. filed their S-1 on Friday after markets closed, giving us a juicy peek into their financial situation. The exchange reported a net loss of $158.5 million on $142.2 million in revenue for 2024, which is already pretty spicy. In just the first six months of 2025, they've managed to lose $282.5 million on only $67.9 million in revenue.

11-year-old crypto exchange Gemini remains unprofitable but is seeking investor funds through an IPO.

Its IPO filing reveals its dire financial state:

H1 2025: $68.6M revenue, $282.5M net loss

2024: $74.3M revenue, $41.4M net loss— FTX Historian (@historian_ftx)

2:15 AM • Aug 16, 2025

Founded back in 2014, Gemini has been busy building an impressive crypto empire, offering everything from exchange services to a USD-backed stablecoin and even a crypto rewards credit card.

Circle Internet Group absolutely crushed their IPO in June, raising $1.2 billion with shares soaring 168% above their $31 IPO price. Meanwhile, Bullish (which also owns CoinDesk, because crypto loves a good media play) pulled in $1.1 billion with shares more than doubling to peak at $118.

With the regulatory environment easing and the Trump administration embracing digital assets, it seems like every crypto company is racing to go public.

Gemini filed for IPO on Nasdaq despite losing $282.5M in the first half of 2025 on just $67.9M revenueThe Winklevoss twins' crypto exchange joins the IPO rush following Circle's blockbuster debut (+168%)Favorable regulatory environment and Trump administration support are driving crypto companies to go publicSEC Chair Wants Regular Folk to Access Private Equity Like the Big Boys

SEC Chair Paul Atkins is apparently feeling generous and wants to give retail investors access to the exclusive private equity playground that's been VIP-only for decades.

🔥 BULLISH: SEC Chair Paul Atkins says “The main reason for doing all this and addressing these various regulations is to provide some certainty for people."

— Cointelegraph (@Cointelegraph)

3:01 AM • Aug 16, 2025

Speaking to Fox Business on Saturday, Atkins pointed to Trump's recent executive order allowing crypto and alternative assets in 401K retirement accounts as the perfect excuse – sorry, catalyst – for this ambitious shake-up. It's apparently "not really great" that big boys like endowments and pension funds get to play in both public and private markets while 401K holders are stuck on the sidelines like financial wallflowers.

Paul Atkins talks to Fox Business host Maria Bartiromo. Source: Fox Business

The SEC Chair is pushing for the Department of Labor and SEC to work together to make this retail investor dream a reality. But don't worry – he's not planning to just "fling the gates open" and watch chaos ensue. Atkins emphasized the need for "proper guardrails" because apparently even he knows that giving everyone access to illiquid, high-risk investments without some safety nets might be a tiny bit problematic.

This move could be huge for crypto investors, potentially opening doors to early-stage crypto projects and private token sales that have traditionally been reserved for accredited investors with deep pockets and allegedly superior financial wisdom. Christopher Perkins from CoinFund has been vocal about how current accreditation rules are basically financial gatekeeping that locks out regular folks.

Current accreditation requirements in the US. Source: SEC

Private investments don't follow the same disclosure requirements as public ones, they're often illiquid, and during financial crises, they can spread contagion.

SEC Chair Paul Atkins wants to expand retail investor access to private equity following Trump's crypto-in-401K executive orderThe move could open early-stage crypto projects and private token sales to everyday investorsProper guardrails are planned, but critics warn of liquidity risks and potential financial contagionAxie Infinity Creator Ronin Network Admits Ethereum Was Right All Along

Ronin network, the blockchain that famously ditched Ethereum in 2021 for greener pastures, just announced they're migrating back as a layer-2 solution by Q2 2026.

Ronin is coming home to Ethereum.

Ready Layer Two ⚔️

Four years ago, we built Ronin because Axie Infinity needed a faster, more efficient network. Ethereum was still early in its scaling roadmap. Necessity was the mother of our invention.

However, things are different now.

— Ronin (@Ronin_Network)

2:09 AM • Aug 15, 2025

The Ronin team – who originally built their blockchain specifically for the Axie Infinity NFT game – basically admitted that Ethereum has had quite the glow-up since they left. In their own words: "Things are different now. Ethereum is back. Transaction costs and speeds are better than ever."

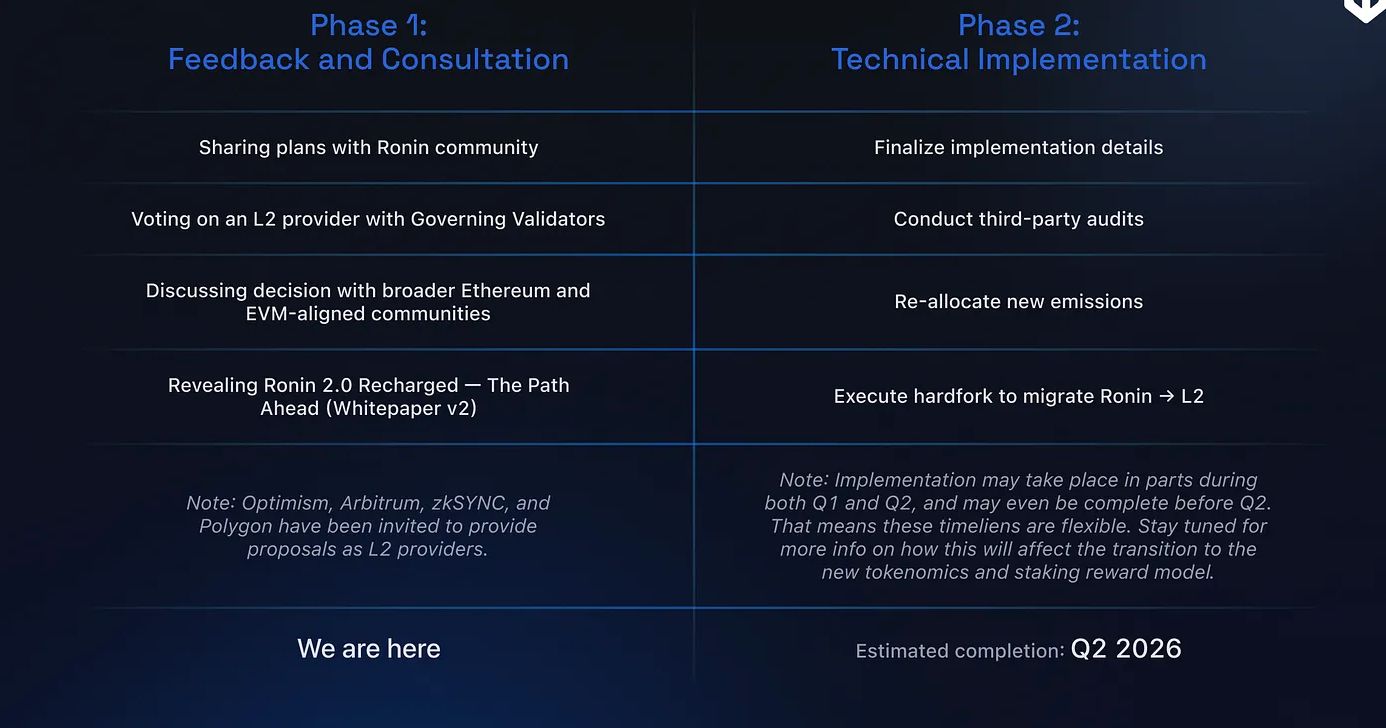

Ronin’s migration to an Ethereum layer-2 network will occur in two phases. Source: Ronin Chain

Back in 2021, Ronin was all about escaping Ethereum's high fees and slow speeds to give Axie Infinity players a better gaming experience. Fast-forward to 2025, and they're singing a completely different tune. Why? Because "Ethereum is winning the war for Wall Street's attention and capital.”

The timing couldn't be more perfect for Ethereum's institutional love story. Etherealize, a marketing company backed by the Ethereum Foundation, has been busy wooing Wall Street investors since January. Meanwhile, Ether treasury companies are popping up like crypto mushrooms, accumulating ETH on their balance sheets and pushing the price to recent highs of around $4,790.

Ronin is becoming Ethereum’s Nintendo.

• Over 5 B USD in NFT volume

• 30 million wallet downloads

• More onchain activity today than at the peak of the Axie boomWhen we started Axie, scaling was central to our plans. We knew that if we got the amount of traction we needed,

— Jihoz.ron (@Jihoz_Axie)

2:19 AM • Aug 15, 2025

Matt Hougan from Bitwise explained that putting ETH into "equity wrappers" gives traditional investors something familiar to sink their teeth into, complete with staking yields that make everyone happy. Add the recent GENIUS bill prohibiting yield-bearing stablecoins in the US, and suddenly Ethereum DeFi looks like the promised land for passive income seekers.

Ronin's transformation from a gaming-specific chain to a general-purpose L2 shows they're not just coming home, they're coming home ambitious and ready to ride Ethereum's institutional wave!

Ronin network will migrate back to Ethereum as a layer-2 by Q2 2026, abandoning its standalone blockchain statusThe decision is driven by Ethereum's improved performance and growing Wall Street institutional interestEther treasury companies and recent regulatory changes are making Ethereum DeFi increasingly attractive to traditional investorsDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). From Bitcoin bribery scandals to Wall Street's crypto love affair, today's stories prove that the digital asset space never fails to deliver the drama alongside the innovation. Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #267

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -