- Proof Of Intel

- Posts

- ETF Exodus Mayhem, CZ's Mystery Pardon, AI Agents Go Shopping, and Canada's Stablecoin Awakening!

ETF Exodus Mayhem, CZ's Mystery Pardon, AI Agents Go Shopping, and Canada's Stablecoin Awakening!

In this edition, navigate the chaos as Bitcoin bleeds billions, Trump pardons someone he "doesn't know," AI agents unlock autonomous payments, and Canada finally regulates stablecoins – all the wild details inside!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From Bitcoin and Ether ETFs bleeding billions while Solana quietly wins, to Trump pardoning CZ (despite claiming he has no idea who he is), AI agents getting their own wallets via the x402 protocol, and Canada finally jumping on the stablecoin regulation train—we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets!

INTEL BRIEF

🟧 While Bitcoin and Ether ETFs hemorrhaged nearly $800 million in five days, Solana ETFs quietly scored their sixth consecutive day of inflows, attracting curious capital with their yield-bearing appeal.

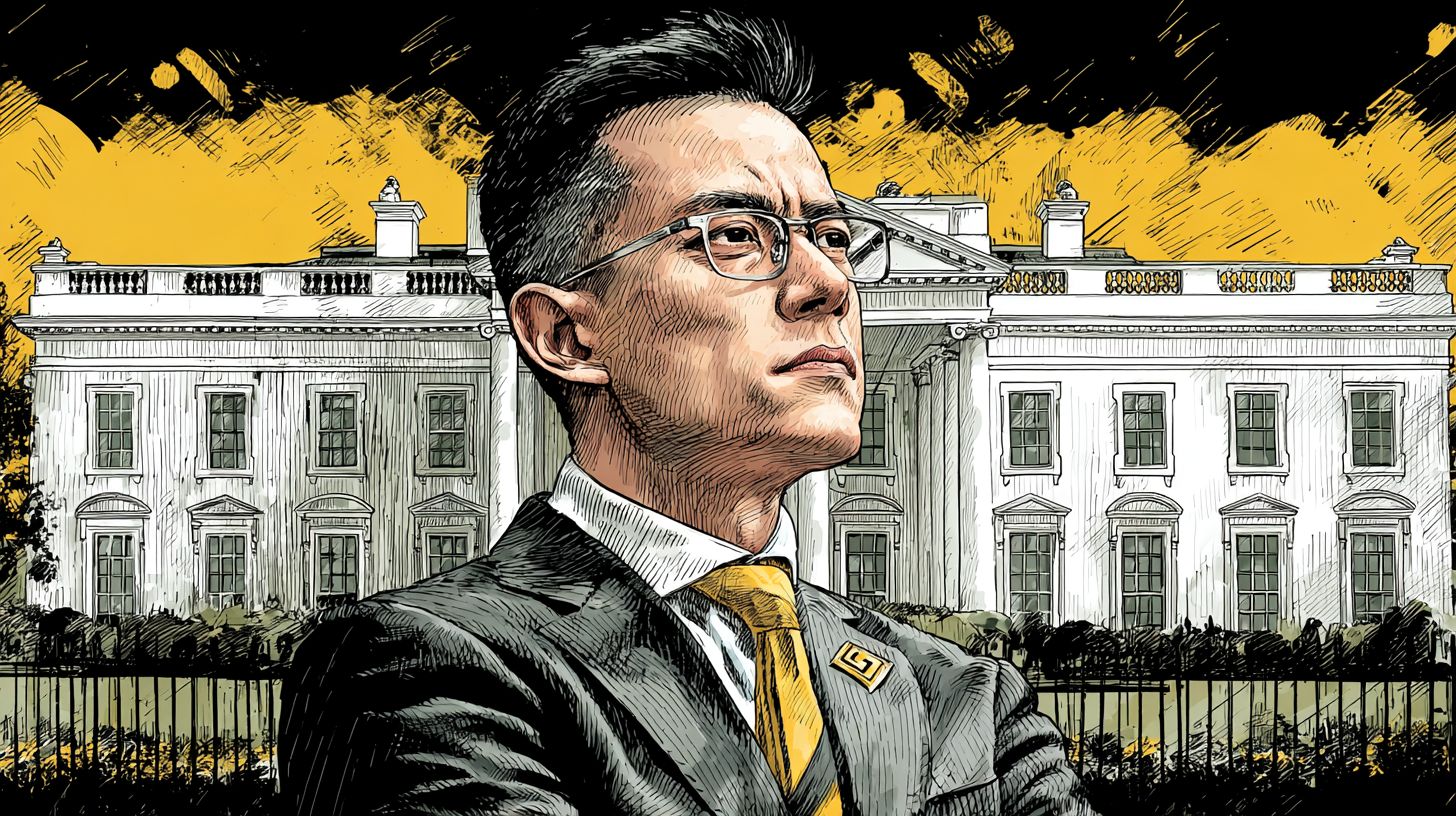

🟧 The White House defended Trump's pardon of Binance founder Changpeng Zhao, claiming it went through a thorough review process—despite Trump admitting in a 60 Minutes interview that he has "no idea" who CZ is.

🟧 The revival of the x402 payment protocol is turbocharging blockchain-based AI agents, enabling them to autonomously transact and potentially creating the first non-human economy—with related token prices surging over 100%.

🟧 Canada announced plans to regulate fiat-backed stablecoins in its 2025 budget, requiring issuers to maintain reserves and implement risk management—following the US's lead after it passed stablecoin legislation in July.

Solana ETFs Keep Winning While Bitcoin and Ether Funds Bleed Nearly $800 Million

Bitcoin and Ether ETFs just wrapped up their fifth consecutive day of bloodletting, with Tuesday marking the worst single-day decline since mid-October. We're talking a combined loss of nearly $800 million in redemptions. Ouch.

Spot Bitcoin ETFs alone shed $578 million on Tuesday, with heavyweights like BlackRock's iShares Bitcoin Trust (IBIT) and Fidelity's FBTC leading the exodus. Meanwhile, Ether ETFs weren't spared either—$219 million walked out the door, bringing the five-day bloodbath to almost $1 billion in losses. Fidelity's FETH and BlackRock's ETHA took the hardest hits, and frankly, it's not a pretty picture.

Solana ETFs see inflows for sixth consecutive day. Source: Farside

But here's where it gets interesting: while Bitcoin and Ether were busy playing hot potato with investor cash, Solana ETFs were quietly having a moment. Spot Solana ETFs pulled in $14.83 million on Tuesday—marking their sixth straight day of inflows. Bitwise's BSOL and Grayscale's GSOL are apparently the new cool kids in town, attracting what Vincent Liu from Kronos Research calls "curious capital."

So what's going on? According to Liu, this isn't about crypto losing its mojo—it's about macro jitters. Institutions are trimming risk as the US dollar flexes and liquidity tightens. Translation: it's not you, crypto—it's the economy.

BITCOIN AND ETHER ETFS START NOVEMBER IN THE RED, SOLANA KEEPS SHINING

Bitcoin ETFs saw $187 million in outflows and Ether funds lost $136 million to start the month, while Solana ETFs attracted $70 million in new inflows, fueling speculation that SOL is fast becoming the new

— Crypto Town Hall (@Crypto_TownHall)

4:30 AM • Nov 5, 2025

But Solana? Liu says it's benefiting from being the "fresh flow meets fresh story" play—a new ETF with yield appeal that's pulling in early adopters chasing growth and staking rewards. Speed, staking, and narrative are keeping Solana's momentum pointed upward, even as the broader market nurses its wounds.

Bitcoin and Ether ETFs bled nearly $800 million over five days amid macro uncertainty and risk-off sentimentSolana ETFs defied the trend with six consecutive days of inflows, pulling in $14.83 million on Tuesday aloneThe divergence is believed to reflect institutions trimming risk while early adopters rotate into Solana's yield-bearing, narrative-driven ETF productsTrump Pardons Binance Founder He Claims Never to Have Met Personally

Welcome to the saga of Changpeng Zhao's pardon—a story that somehow manages to be both confusing and perfectly on-brand for 2025.

White House press secretary Karoline Leavitt stepped up to the podium Tuesday to assure everyone that CZ's pardon was handled with the "utmost seriousness." According to Leavitt, a whole team of qualified lawyers at the Department of Justice and White House Counsel's office reviewed the case before it landed on President Trump's desk for the final stamp of approval.

Press secretary Karoline Leavitt addressed reporters about Zhao’s pardon in a briefing on Tuesday. Source: YouTube

But here's where it gets spicy: In a 60 Minutes interview on Sunday, Trump defended the pardon by saying he had "no idea" who Zhao is and dismissed criticism as politically motivated. Leavitt quickly clarified that Trump simply meant he doesn't know CZ personally—you know, just a casual "never met the guy" situation before pardoning him. Totally normal!

The pardon comes amid reports (which Binance CEO Richard Teng has denied) suggesting Binance helped the Trump family's crypto venture, World Liberty Financial, with building a stablecoin and securing a $2 billion investment deal. Nothing to see here, folks!

An excerpt of the transcript showing a question that was cut from the broadcast. Source: CBS News

Leavitt claimed Zhao was "over-prosecuted by a weaponized DOJ" under Biden. CZ pleaded guilty in November 2023 to failing to maintain an effective Anti-Money Laundering program at Binance. Prosecutors wanted three years, but the judge called that "too harsh" and gave him four months instead—which he served starting April 2024.

Oh, and in a delicious twist? 60 Minutes cut a question from the broadcast where reporter Norah O'Donnell asked Trump if he was concerned about "the appearance of corruption." Trump's response? "I'd rather not have you ask the question." The transcript notes the interview was "condensed for clarity," which is journalism speak for "we edited out the awkward bits."

White House claims CZ's pardon underwent a "thorough review process" despite Trump saying he has "no idea" who Zhao is personallyCZ was pardoned after serving four months for failing to maintain proper Anti-Money Laundering compliance at Binance60 Minutes cut a question about potential corruption concerns from the broadcast, with Trump stating he'd "rather not" answer itThe x402 Protocol Just Gave AI Agents Wallets and Created a Non Human Economy

Web3 AI agents just learned how to pay for things themselves, and the market is absolutely losing it.

The x402 protocol—a revival of the internet's long-forgotten HTTP 402 "Payment Required" status code—is giving AI agents the ability to make autonomous payments without human intervention. Think of it as giving your digital assistant its own credit card, except it's blockchain-based, trustless, and auditable. Coinbase developers dusted off this relic and turned it into a practical payment rail, primarily using stablecoins like USDC on Base, Coinbase's Layer 2 network.

Here's how it works: An AI agent hits a paywall, the server says "402 Payment Required" with the price and wallet address, the agent sends payment on-chain, provides proof via transaction hash, and boom—access granted. No custom wallets, no plugins, just seamless micro-transactions happening invisibly in the background.

Adding $x4ai to my bag

Been eyeing this one for a while — a modular, autonomous AI agent built on the x402 protocol.

CA: 8eCD6RCYYWtfH7bY7v4i6CikEChWRZHZsj2z4G72pump

It’s building an ecosystem where AI becomes an economic entity — able to earn, spend, and evolve on its own.

— Whale 鲸鱼 🔶 BNB (@chinapumprocket)

4:09 PM • Nov 3, 2025

Why does this matter? Because Web3 AI agents are fundamentally different from your centralized buddies like Google Assistant or Alexa. Those tools are glorified interfaces tethered to corporate overlords. Blockchain-based agents, however, have their own on-chain identities—think wallet addresses or smart contracts—making them autonomous and self-sovereign.

The biggest ecosystem right now is Virtuals ($VIRTUAL), which lets users build and monetize agents. Notable examples include AIXBT ($AIXBT), a crypto-focused social agent, and ArAIstotel ($FACY), a fact-checker. Other frameworks like Fetch.ai ($FET) and ElizaOS ($AI16Z) are also in the mix, alongside independent agents like Cookie.fun ($COOKIE) and Clanker ($CLANKER).

The market's reaction? Absolutely bonkers. After x402 adoption, $VIRTUAL jumped 128%, $CLANKER exploded 436%, and $AIXBT doubled. On-chain transactions skyrocketed 34,300% in a single week, hitting over 932,000 transactions according to Dune Analytics.

innovation always starts small before it spreads.

ai agents are still underestimated, but won’t stay that way.

google & openai both believe agents will be central to ai next big leap especially because they can code and handle payments

powered by x402 is a trillion-dollar

— satsbased (@satsbased)

8:04 PM • Nov 4, 2025

As Shaw Walters from Eliza Labs noted, x402 is the missing piece for making the "agentic web" economically viable. This could reshape content monetization—imagine websites charging a few cents per interaction instead of bombarding you with ads. The entire process would be invisible to users, creating frictionless micro-economies.

PayPal CEO Alex Chriss summed it up perfectly: if you don't believe in agentic commerce, "go watch an 18-year-old have a conversation with their AI agent. You've lost the plot."

x402 protocol enables AI agents to make autonomous on-chain payments, unlocking the first truly non-human economyAI agent tokens surged massively—$VIRTUAL up 128%, $CLANKER up 436%, with on-chain transactions jumping 34,300% in one weekThe technology could revolutionize internet monetization by replacing ads and subscriptions with frictionless micro-payments handled invisibly by AI agentsCanada Announces Stablecoin Regulations Following the US Playbook

Canada finally looked south of the border and thought, "You know what? The Americans might be onto something." The Great White North just unveiled plans to regulate fiat-backed stablecoins in its 2025 federal budget, joining the regulatory party nearly four months after the US passed its landmark GENIUS Act in July.

According to Tuesday's budget release, stablecoin issuers will need to jump through some hoops: maintaining sufficient reserves, establishing redemption policies, and implementing risk management frameworks that protect personal and financial data. Basically, the government wants to make sure your digital dollars don't go poof in the middle of the night.

🇨🇦 Canada just made a big step forward.

Today’s federal budget includes new guidance on stablecoin regulation, signaling progress toward embracing faster, cheaper, and borderless payments.

With 60,000 advocates strong, Stand with Crypto Canada will continue to be a driving

— Stand With Crypto Canada 🇨🇦 (@StandWCrypto_CA)

9:28 PM • Nov 4, 2025

The Bank of Canada is allocating $10 million over two years starting in fiscal 2026-2027 to get the regulatory machine running smoothly. After that, it's speculated they'll need about $5 million annually—which will be offset by fees from stablecoin issuers regulated under the Retail Payment Activities Act. So don't worry, taxpayers—the stablecoin folks are footing the bill.

Coinbase Canada CEO Lucas Matheson is basically doing cartwheels over this news, telling CBC on Monday that it would "change how Canadians interact with money and the internet forever." Bold claim, Lucas, but we respect the enthusiasm!

The timing makes sense when you consider the stablecoin market currently sits at a whopping $309.1 billion, and the US Treasury believes it'll balloon to $2 trillion by 2028. Major players like Western Union, SWIFT, MoneyGram, and Zelle have all either integrated or announced plans to integrate stablecoin solutions recently, so institutional adoption is clearly heating up.

🇨🇦 NEW: Canada unveils plan to regulate stablecoins in its 2025 federal budget, following the US GENIUS Act.

Issuers must maintain sufficient reserves and robust risk management.

— Cointelegraph (@Cointelegraph)

7:00 AM • Nov 5, 2025

Canada's already got skin in the game too. Tetra Digital, one of the top Canadian stablecoin players, raised $10 million to create a digital Canadian dollar with backing from heavyweights like Shopify, Wealthsimple, and the National Bank of Canada.

Interestingly, this comes after Canada abandoned its central bank digital currency (CBDC) plans back in September 2024, with Bank of Canada Governor Tiff Macklem stating there wasn't a "compelling case" to move forward at the time. Guess they decided private stablecoins are the way to go instead!

Canada's 2025 budget includes plans to regulate fiat-backed stablecoins, requiring issuers to maintain reserves and implement risk managementThe move follows the US passing the GENIUS Act in July, with Canada allocating $10 million to launch the regulatory frameworkThe stablecoin market sits at $309.1 billion and is believed to potentially hit $2 trillion by 2028, with major institutions like Western Union and SWIFT jumping on boardDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #295

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -