- Proof Of Intel

- Posts

- Gold smashes $5K mark for the first time in history, A16z's Shutdown Spree, and much more!

Gold smashes $5K mark for the first time in history, A16z's Shutdown Spree, and much more!

From precious metals outshining crypto, protocol debates heating up, startups calling it quits, to miners saving the grid one shutdown at a time!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From gold hitting a historic $5K while Bitcoin takes a breather, to Saylor stirring the pot on protocol changes, a16z-backed startups calling it quits, and Bitcoin miners becoming grid heroes during a massive winter storm—we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets!

INTEL BRIEF

🟧 Gold smashed through $5,000 while Bitcoin nosedived to $86,000, showing these two assets are officially in their "it's not you, it's me" era.

🟧 Michael Saylor claimed "ambitious opportunists" pushing protocol changes are Bitcoin's biggest threat, igniting a spicy debate about whether Bitcoin should evolve or stay frozen in time.

🟧 A16z-backed crypto startup Entropy is shutting down and refunding investors after four years of pivots and failing to find a scalable business model.

🟧 Foundry USA's Bitcoin mining hashrate plummeted ~60% as miners across the US shut down operations during winter storm Fern to help stabilize the power grid.

Gold Smashes Through $5K as Bitcoin Tumbles to $86K in Epic Divergence

Gold just flexed harder than your gym bro posting his protein shake routine, blasting past the $5,000 mark while Bitcoin sulked its way down to $86,000. Talk about a glow-up versus a glow-down situation!

The shiny yellow metal surged 17% in January alone, hitting a record $5,080 as traders ran toward it like it was the last slice of pizza at a party. Why the stampede? Apparently, fears of a potential US government shutdown and President Trump's escalated tariff threats have everyone feeling spicier than a jalapeño in a sauna.

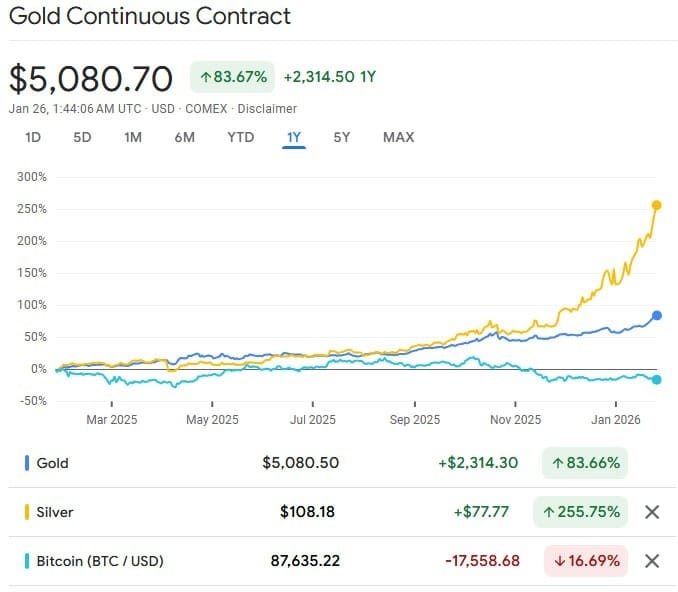

Gold prices have surged 83% since the same time last year, while Bitcoin has declined 17%. Source: Google Finance

The Kobeissi Letter wasn't wrong when they said "A likely government shutdown just added fuel to the fire for precious metals." And speaking of fire, Trump threatened Canada with a 100% tariff over a China trade deal because subtlety is apparently not on the menu anymore.

Meanwhile, Bitcoin lost 1.6% on the day and is now chilling 30% below its October peak of $126,000. Ouch. That's gotta sting worse than stepping on a LEGO. And here's a fun fact: Gold beat Ethereum to the $5K milestone, closing out a Polymarket bet from October. ETH is currently face-down at sub-$2,800, more than 40% down from its all-time high. Double ouch.

Silver also joined the party, popping above $107 per ounce for the first time ever—up 48% in 2026.

Jeff Mei from BTSE exchange believes investors are ditching US Treasuries for gold because, well, government shutdowns and tariff tantrums aren't exactly confidence-boosters. In uncertain times, people want safe-haven assets, and right now gold is giving "reliable friend" energy while crypto is giving "reads your messages but doesn't reply" vibes.

Gold hit a record $5,080 (up 17% in January) while Bitcoin dropped to $86K (down 30% from its October peak)Trade tensions and potential government shutdown are pushing investors toward gold as the ultimate safe-haven assetSilver also surged above $107 for the first time ever, while ETH tanked below $2,800—gold officially won the race to $5KMichael Saylor Claims Ambitious Opportunists Are Bitcoin's Biggest Threat

Michael Saylor just threw a grenade into the Bitcoin community chat and now everyone's arguing like it's Thanksgiving dinner with your conspiracy theorist uncle.

The Strategy co-founder dropped a hot take that "ambitious opportunists" trying to push protocol changes are the biggest threat to Bitcoin. Not hackers. Not regulations. Not even your cousin who keeps asking if he should "buy the dip." Nope—it's the people who want to, you know, change things.

Bitcoin maximalist Justin Bechler speculated Saylor's beef is with software developers pushing non-monetary use cases like NFTs and onchain images. You know, the stuff that makes Bitcoin blocks look like a digital scrapbook instead of a pristine ledger.

But not everyone's vibing with Saylor's take. Investor Fred Krueger believes quantum computing is the real threat, while Mert Mumtaz from Helius went full savage mode, calling Saylor's mindset an "absolute cancer." Mumtaz fired back: "Nothing is infallible, certainly not Bitcoin, which has had tons of bugs until now... perhaps let's let those bugs stay instead of patching them." Damn, Mert woke up and chose violence.

The drama centers around the ongoing spam wars and Bitcoin Improvement Proposal 110 (BIP-110)—a temporary soft fork aimed at filtering out non-monetary data from Bitcoin's blockchain. It's basically the digital equivalent of Marie Kondo asking, "Does this spark joy?"

Meanwhile, the quantum computing debate continues to rage on. Nic Carter from Castle Island has been sounding the alarm that Bitcoin needs post-quantum standards ASAP, but Adam Back from Blockstream basically told him to chill, calling his warnings "uninformed noise" and insisting developers are quietly doing the research.

Bitcoin analyst James Check weighed in too, saying quantum fears aren't affecting Bitcoin's price—the recent dump is just long-term holders selling off their bags. So basically, it's not the quantum computers we should fear; it's the whales.

Michael Saylor claims "ambitious opportunists" pushing Bitcoin protocol changes are the network's biggest threatThe comments sparked massive debate between those wanting to ossify Bitcoin vs. developers pushing for upgrades like quantum-resistant addressesQuantum computing remains controversial—some say it's urgent, others say it's overblown, and Bitcoin's price seems unbothered either wayEntropy Shuts Down and Refunds Investors After Four Years of Pivots

Pour one out for Entropy, folks—another crypto startup is biting the dust and handing back the bag to investors. 🪦

Founder and CEO Tux Pacific announced on Saturday that after four years, multiple pivots, and two rounds of layoffs, Entropy just couldn't find its groove. Pacific's basically saying, "We tried, we failed, here's your money back"—which is honestly more honorable than ghosting like some projects we know.

Entropy launched back in late 2021 as a decentralized self-custody solution and scored a chunky $25 million seed round in June 2022 from heavy hitters like Andreessen Horowitz (a16z) and Coinbase Ventures. Not too shabby for a start!

But here's where things got messy. In the second half of 2025, Entropy pivoted to building a crypto automations platform with AI integration—think Zapier but for crypto. Sounds cool, right? Well, apparently the business model wasn't "venture scale," which is VC speak for "this ain't gonna make us billions, chief."

Pacific was left staring at two options: get creative or pivot again. After four years of grinding in the crypto trenches, he decided enough was enough. As he put it: "The best I could do has already been done: it was time to close up shop." Respect for knowing when to fold, honestly.

Plot twist: Entropy isn't the only a16z-backed project recently calling it quits (sort of). Farcaster, the decentralized social networking protocol, also made headlines Thursday for returning $180 million to investors amid a takeover by infrastructure provider Neynar. Though co-founder Dan Romero was quick to clarify that Farcaster isn't shutting down—just pivoting to a more developer-focused direction under new management.

Still, two a16z projects returning funds in one week? That's gotta sting a little.

Entropy is shutting down after four years and returning capital to investors, including a16z and Coinbase Ventures ($25M seed round)The startup struggled to find product-market fit despite pivoting from self-custody to a crypto automations platform with AIComes on the heels of Farcaster returning $180M to investors (though Farcaster itself isn't shutting down, just restructuring)Bitcoin Miners Power Down as Winter Storm Fern Triggers Mass Curtailments

Foundry USA's mining pool saw its hashrate nosedive by roughly 60% since Friday—that's a whopping 200 exahashes per second (EH/s) going offline as winter storm Fern decided to throw the US a frosty curveball. According to TheMinerMag, block production temporarily slowed to 12 minutes as miners across the country hit the off switch.

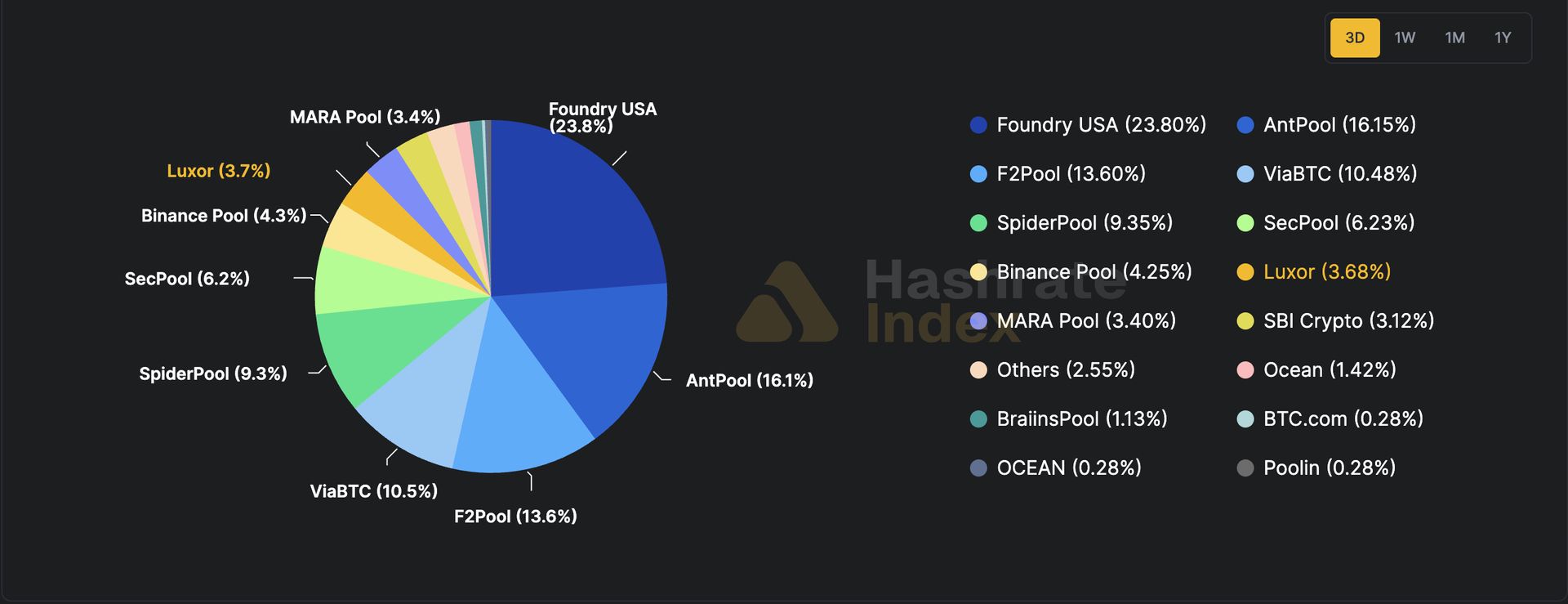

Despite the drop, Foundry USA still commands about 198 EH/s, holding roughly 23% of the global mining pool hashrate. Not too shabby for operating in blizzard mode. But they weren't alone—other US-based mining pools like Luxor also felt the chill as miners curtailed operations to ease the burden on stressed power grids.

A breakdown of hashing power controlled by different Bitcoin mining pools. Source: Hashrate Index

Now here's where it gets interesting: Bitcoin miners aren't just crypto nerds with fancy computers—they're basically grid superheroes. They act as a controllable load resource, meaning they can power up when demand is low (siphoning off excess energy that could damage infrastructure) and power down during peak demand (letting energy flow to homes and businesses). It's like having a dimmer switch for the entire electrical grid, but way cooler.

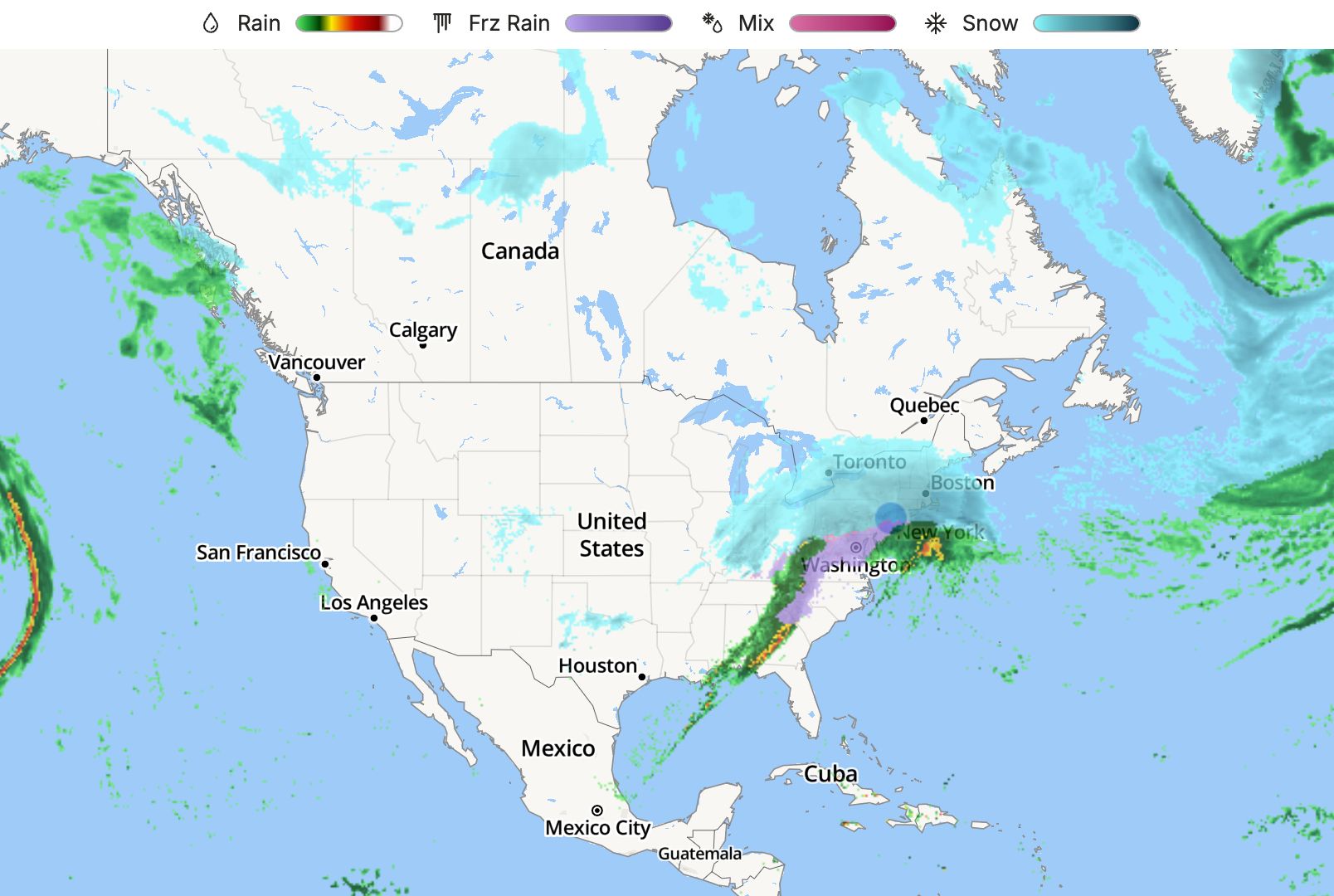

Winter storm Fern is impacting large swaths of the US. Source: The Weather Channel

Winter storm Fern is currently unleashing a brutal mix of snow, ice, and freezing rain across the Southeastern US, Northeast, and parts of the Midwest. The Weather Channel reported the storm stretches about 1,800 miles and has caused widespread power outages affecting over 1 million residents. Yikes.

So while your Bitcoin transactions might be moving a tad slower right now, at least you can thank the miners for making sure grandma's heater stays on during the storm. Priorities, people!

Foundry USA's hashrate dropped ~60% (nearly 200 EH/s) since Friday as miners curtailed operations due to winter storm FernBitcoin miners act as grid stabilizers, powering down during peak demand to help ease strain on electrical infrastructureWinter storm Fern is impacting 1,800 miles of the US with 1M+ residents experiencing power outages—miners are helping keep the lights onDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! 🎬 I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #328

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -