- Proof Of Intel

- Posts

- Mugafi's Hollywood Takeover, Strategy's $1.44B FUD-Buster, MSCI's Bitcoin Blacklist Battle, and Yoodli's $300M AI Revolution!

Mugafi's Hollywood Takeover, Strategy's $1.44B FUD-Buster, MSCI's Bitcoin Blacklist Battle, and Yoodli's $300M AI Revolution!

From tokenizing movies to silencing haters with billions, battling index giants, and building AI that actually helps humans – buckle up for the wildest tech rollercoaster of the week!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From Mugafi tokenizing Hollywood and Strategy silencing the FUD to Strive battling MSCI's Bitcoin blacklist and an ex-Googler's AI startup that actually wants to help you (not replace you), we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of blockchain entertainment, Bitcoin treasuries, and AI innovation!

INTEL BRIEF

🟧 Mugafi partners with Avalanche to tokenize over 1,000 entertainment properties, aiming to revolutionize how films, anime, and music are funded and distributed onchain.

🟧 Strategy's CEO Phong Le raised $1.44 billion in just eight days to silence FUD about dividend payments and prove the company can raise capital even during Bitcoin downturns.

🟧 Strive CEO Matt Cole urges MSCI to abandon its proposed 50% Bitcoin holding threshold for index exclusion, arguing it would hurt passive investors and fail to capture the intended companies.

🟧 Ex-Google engineer's AI communication startup Yoodli triples its valuation to $300M+ by focusing on AI that assists people with speaking skills rather than replacing them.

Mugafi Partners With Avalanche to Tokenize Over 1000 Films and Entertainment Properties

Mugafi, an AI-powered platform specializing in entertainment IP, just announced a partnership with Avalanche to tokenize films, anime, music, and other media assets. Translation? Creators can now finance and distribute their projects directly onchain instead of begging traditional studios for funding while sacrificing their creative souls.

Here's where it gets spicy: Mugafi isn't just throwing random scripts at the blockchain and hoping for the best. Their AI systems are trained on thousands of scripts and story structures, helping evaluate which projects deserve onchain financing. It's like having a super-smart studio executive who never sleeps and doesn't play favorites.

Mugafi’s Kuberaa film. Source: Mugafi

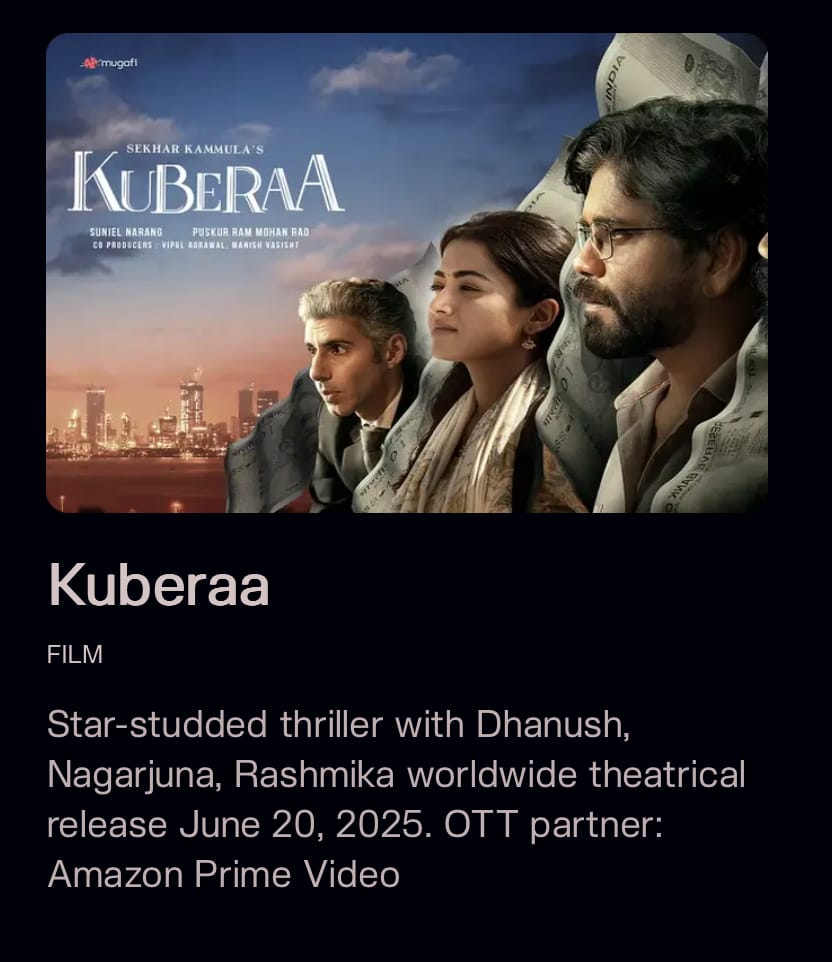

The duo is starting with $10 million in entertainment IP financing, but they're not thinking small—their long-term goal is to exceed $1 billion annually in IP financing throughput. That's a lot of movies, music, and anime, friends.

Mugafi itself is no rookie—launched in 2020 in India and backed by entertainment heavyweights like Netflix, Amazon, and Panorama Studios, the company already has box office cred. Their 2025 release Kuberaa pulled in $35 million and landed on Amazon Prime Video. Not too shabby for a Web3-friendly studio!

IP registered on Story between March and June 2025. Source: Story Foundation

Avalanche is betting big that this partnership will showcase how its network can handle large-scale real-world asset issuance. The companies plan to use Avalanche's infrastructure to fund, track, and distribute entertainment projects onchain, creating transparency that traditional Hollywood could only dream of.

The collaboration is expected to create more than 1,500 creator and studio opportunities across India, North America, Japan, and Korea. If you're in AI, production, blockchain ops, or compliance, your inbox might be getting interesting soon.

Mugafi partners with Avalanche to tokenize 1,000+ films, anime, and music projects using AI-powered evaluation systemsStarting with $10M in financing, targeting $1B+ annually in entertainment IP throughputPartnership expected to create 1,500+ opportunities across multiple regions including India, Japan, and North AmericaStrategy CEO Raises $1.44 Billion in Just Eight Days to Kill Bitcoin Treasury FUD

Strategy CEO Phong Le went on CNBC's Power Lunch to address what he calls "FUD" (fear, uncertainty, and doubt, for the uninitiated) surrounding his company's ability to pay dividends during Bitcoin's recent price slump. Spoiler alert: They're more than fine.

"We're very much a part of the crypto ecosystem and Bitcoin ecosystem. Which is why we decided a couple of weeks ago to start raising capital and putting US dollars on our balance sheet to get rid of this FUD," Le explained, probably while sipping coffee and checking Bitcoin charts.

Here's the tea: Investors were reportedly getting nervous about whether Strategy could continue servicing its debts and dividend obligations if the stock price tanked too hard. Short sellers were circling like sharks, betting that Strategy would have to sell its precious Bitcoin stash to stay afloat.

Le wasn't having it. The company announced a $1.44 billion USD reserve on Monday, funded through a stock sale. This reserve is designed to cover at least 12 months of dividends initially, with plans to expand that runway to 24 months. But wait—it gets better.

"In eight and a half days we raised $1.44 billion—21 months' worth of dividend obligations," Le said, flexing harder than a gym bro on New Year's Day. "We did it 1) to address the FUD, but 2) to show people that we're still able to raise money in a Bitcoin downcycle."

Le made it clear: Strategy wasn't going to have to sell Bitcoin to meet obligations, but the FUD was causing people to pile into short positions. So they nuked the narrative from orbit.

The company also launched a slick "BTC Credit" dashboard that claims Strategy currently has enough assets to service dividends for more than 70 years. That's right—70 years. Your great-grandkids might still be cashing those dividend checks.

Le previously stated that Strategy would only consider selling Bitcoin if the stock fell below net asset value AND the company lost access to fresh capital. Clearly, neither scenario is happening anytime soon.

Strategy raised $1.44B in 8.5 days (21 months of dividend coverage) to eliminate FUD during Bitcoin's downturnCEO Phong Le emphasized the company won't need to sell Bitcoin and can still raise capital in down marketsNew "BTC Credit" dashboard claims enough assets to pay dividends for 70+ yearsStrive Calls Out MSCI for Trying to Blacklist Bitcoin Companies From Major Indexes

MSCI, one of the world's biggest index providers, is apparently trying to kick Bitcoin treasury companies out of its indexes, and Strive isn't having it.

In a letter to MSCI's chairman and CEO Henry Fernandez, Strive CEO Matt Cole called out the index giant's proposed rule that would exclude companies whose digital asset holdings exceed 50% of total assets. Cole's message? "Let the market decide."

Here's why this matters: Losing a spot in MSCI indexes is basically financial exile. JPMorgan analysts warned that Strategy (yes, the same company from article #2) could lose $2.8 billion if MSCI goes through with this proposal. That's not pocket change, even in crypto land. Strategy chair Michael Saylor has confirmed his company is in talks with MSCI about the issue—probably with his lawyer on speed dial.

But Cole argues this blacklist doesn't just hurt Bitcoin companies—it hurts passive investors by cutting them off from major growth sectors. And get this: many of the companies on the chopping block are pivoting hard into AI infrastructure.

Bitcoin miners like MARA Holdings, Riot Platforms, and Hut 8 are rapidly transforming their data centers to provide power and infrastructure for AI computing. "Many analysts argue that the AI race is increasingly limited by access to power, not semiconductors," Cole explained. "Bitcoin miners are ideally positioned to meet this rising demand."

Translation? These aren't just crypto bros hoarding digital coins—they're becoming critical AI infrastructure players. But even as AI revenue rolls in, their Bitcoin holdings remain, and so would MSCI's exclusion.

Cole also pointed out that companies like Strategy and Metaplanet offer investors products similar to Bitcoin-linked structured notes from traditional finance giants like JP Morgan, Morgan Stanley, and Goldman Sachs. "Bitcoin structured finance is as real a business for us as it is for JPMorgan," he said, calling the asymmetry "unfair competition."

Then there's the practical nightmare of enforcement. Cole argues that tying index inclusion to a volatile asset would cause companies to "flicker" in and out of the index, creating management headaches and tracking errors. Plus, how do you even measure when holdings hit 50%? Companies gain crypto exposure through derivatives, ETFs, and various instruments.

Case in point: Trump Media & Technology Group holds the tenth-largest public Bitcoin treasury but didn't make the preliminary exclusion list because its spot holdings are just under 50%. Why? Because it uses derivatives and ETFs instead of direct holdings. Loophole much?

Instead of a blanket ban, Strive suggests MSCI create an "ex-digital asset treasury" version of its indexes. That way, investors who want to avoid Bitcoin companies can opt out, while others can access the full investable equity universe.

Strive urges MSCI to drop its 50% Bitcoin holding exclusion rule, calling it unworkable and harmful to passive investorsMajor Bitcoin miners like MARA and Riot are becoming AI infrastructure providers, making exclusion short-sightedStrive proposes an "ex-digital asset treasury" index version to let the market decide instead of blanket bansFormer Google Engineer's Communication AI Startup Yoodli Hits $300 Million Valuation

In a world where AI seems hellbent on automating everyone out of a job, Yoodli is taking a refreshingly different approach: building AI that helps you get better at your job instead of taking it from you.

The Seattle-based communication training startup just hit a valuation of more than $300 million—triple its level from just six months ago—following a $40 million Series B round led by WestBridge Capital. Combined with its $13.7 million Series A from May, Yoodli has now raised nearly $60 million total. Not bad for a four-year-old company!

Varun Puri, who previously worked at Google's X division (the moonshot factory) and handled special projects for Sergey Brin himself, co-founded Yoodli with former Apple engineer Esha Joshi in 2021. Puri's motivation? Personal experience. After moving to the U.S. at 18, he witnessed how difficulty expressing ideas or speaking confidently affected students and young professionals from countries like India—including himself.

Here's the problem Yoodli solves: two out of three people struggle with public speaking, according to the company's internal data. But instead of just helping you practice speeches, Yoodli evolved into something bigger. Users started leveraging the platform for interview prep, sales pitches, and difficult conversations, pushing the startup from consumer product to enterprise training powerhouse.

Now, companies including Google, Snowflake, Databricks, RingCentral, and Sandler Sales use Yoodli for employee or partner training. The platform runs AI-powered simulated scenarios—think sales calls, leadership coaching, interviews, and feedback sessions—giving users structured, repeatable practice to improve their communication skills.

"In the old world, companies would be training people using static, long-form content or passive videos that we'd all watch at 4x-5x speed, just to get the thing done," Puri explained. "But that doesn't actually mean you've learned it." Preach.

The platform works with multiple large language models, so enterprises can use Google's Gemini or OpenAI's GPT based on preference. It supports most major languages, including Korean, Japanese, French, and various Indian languages. Companies can embed it into existing software or users can access it directly through a web browser.

Puri is philosophical about AI's limits: "I philosophically believe that AI can get you, let's call it from a zero to an eight or a zero to nine. But the pure essence of who you are and how you show up, and your authenticity and vulnerability that a human gives you feedback on will always exist."

The numbers back up the hype: between Series A and B, Yoodli saw a 50% increase in role-plays run on the platform and total practice time. The startup also claims 900% growth in average recurring revenue over the last 12 months—though specific figures weren't disclosed (mysterious, we like it).

Yoodli has beefed up its leadership team recently, hiring former Tableau and Salesforce executive Josh Vitello as CRO, former Remitly CFO Andy Larson as CFO, and former Tableau CPO Padmashree Koneti as CPO. With about 40 employees currently, the company plans to expand into Asia-Pacific markets while deepening its U.S. presence.

Yoodli triples valuation to $300M+ after raising $40M Series B, focusing on AI that assists rather than replaces peoplePlatform provides AI-powered communication training for companies like Google, Snowflake, and DatabricksSaw900% growth in recurring revenue and 50% increase in platform usage between funding roundsDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). From onchain movie magic to billion-dollar FUD busters and AI that won't steal your job, today's stories prove that tech keeps getting wilder. Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #303

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -