- Proof Of Intel

- Posts

- Musk Drops $16.5B on Samsung Chips, Solana Boss Calls Own Users "Digital Slop Addicts," and Corporate Whales Devour ETH Faster Than It's Made!

Musk Drops $16.5B on Samsung Chips, Solana Boss Calls Own Users "Digital Slop Addicts," and Corporate Whales Devour ETH Faster Than It's Made!

In this edition, Mochi serves up Tesla's Samsung love affair, co-founder controversies, eyeball-scanning microloans, and whale-sized ETH hoarding – buckle up for today's crypto chaos!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From Tesla's massive chip romance with Samsung and Solana's co-founder roasting his own platform to eyeball-scanning crypto loans and corporate ETH hoarding madness, we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets!

INTEL BRIEF

🟧 Tesla inked a massive $16.5 billion chip supply deal with Samsung for next-gen AI6 chips, sending Samsung's stock soaring over 6% while Musk hints the actual output could be "several times higher.”

🟧 Solana co-founder Anatoly Yakovenko called memecoins and NFTs "digital slop" with no intrinsic value, sparking backlash from the crypto community despite Solana's heavy reliance on memecoin revenue.

🟧 Divine Research issued 30,000+ unbacked crypto loans using Sam Altman's World ID for verification, targeting underserved borrowers with high-risk microloans at 20-30% interest rates despite 40% default rates.

🟧 SharpLink Gaming dropped $295 million on 77,210 ETH – more than Ethereum's entire monthly issuance – while appointing BlackRock veteran Joseph Chalom as co-CEO and eyeing a $6 billion stock sale for more crypto purchases.

Tesla Signs $16.5B Samsung Chip Deal Sending Stocks Soaring

The Tesla CEO announced a whopping $16.5 billion chip supply deal with Samsung Electronics that's got Wall Street buzzing louder than a Model S in Ludicrous mode.

Elon Musk says Tesla has signed a $16.5 billion contract for the supply of semiconductors that should be a big boost for Samsung’s loss-making contract chip-making business reut.rs/4mm39bb

— Reuters (@Reuters)

8:30 AM • Jul 28, 2025

Samsung's giant new Texas fab being dedicated exclusively to churning out Tesla's next-generation AI6 chips. Musk took to X (because where else?) to declare the "strategic importance of this is hard to overstate," which in Musk-speak basically means "this is a really, really big deal, folks."

Our favorite tech billionaire is speculated to believe that the $16.5 billion figure is just the appetizer. In classic Musk fashion, he teased that the "actual output is likely to be several times higher" than the initial investment.

Samsung's shares jumped a spectacular 6.83% to close at ₩70,400, while Tesla's stock got a nice 1.57% bump in premarket trading. Not too shabby for a Monday morning announcement!

Samsung agreed to allow Tesla to assist in maximizing manufacturing efficiency.

This is a critical point, as I will walk the line personally to accelerate the pace of progress. And the fab is conveniently located not far from my house 😃

— Elon Musk (@elonmusk)

3:36 AM • Jul 28, 2025

The partnership isn't just about throwing money around (though $16.5 billion is quite the throw). Samsung agreed to let Tesla help maximize manufacturing efficiency, which is believed to be a win-win situation. Think of it as Tesla bringing their optimization magic to Samsung's chip-making wizardry.

Timeline-wise, we're looking at the A15 chips rolling out by end of 2026, with the A16 chips following suit. Though analysts are speculated to expect production might actually kick off around 2027-2028, considering Tesla's, uh, creative relationship with deadlines.

Tesla signed a $16.5B chip deal with Samsung for next-gen AI6 chips, with Samsung's Texas fab going all-in on Tesla productionSamsung stock soared 6.83% while Tesla gained 1.57% in premarket trading following the announcementProduction expected 2027-2028 despite Musk's optimistic 2026 timeline, with the deal running through 2033Solana Co-Founder Calls Memecoins Digital Slop Despite Platform Profits

The Solana co-founder decided Sunday was the perfect day to ruffle some feathers by declaring memecoins and NFTs are "digital slop" with zero intrinsic value.

Base creator Jesse Pollak, where Yakovenko doubled down. He compared memecoins to loot boxes in mobile games – you know, those sneaky little digital slot machines that make your wallet cry. "I've said this for years," Yakovenko proclaimed, apparently forgetting that his platform is basically the memecoin capital of crypto.

@jessepollak I’ve said this for years. Memecoins and NFTs are digital slop and have no intrinsic value. Like a mobile game loot box. People spend $150b a year on mobile gaming.

— toly 🇺🇸 (@aeyakovenko)

7:13 PM • Jul 27, 2025

Solana wouldn't be where it is today without memecoins, and Yakovenko knows it! He even admitted as much, but then tried to justify it by saying Apple wouldn't be successful without loot boxes either.

Pollak fired back with some philosophical wisdom, arguing that "the content itself is valuable, just like a painting is fundamentally valuable" regardless of museum admission fees. Meanwhile, the crypto community went absolutely ballistic over Yakovenko's comments. User "Caps" called him out for mocking his own user base, while crypto commentator Karbon noted the distasteful approach of promoting something you believe is worthless.

@DegenerateNews Memecoins and NFTs have no value. Neither do loot boxes, and that business has enough revenue to destroy the second largest army in Europe every year.

— toly 🇺🇸 (@aeyakovenko)

6:13 PM • Oct 6, 2024

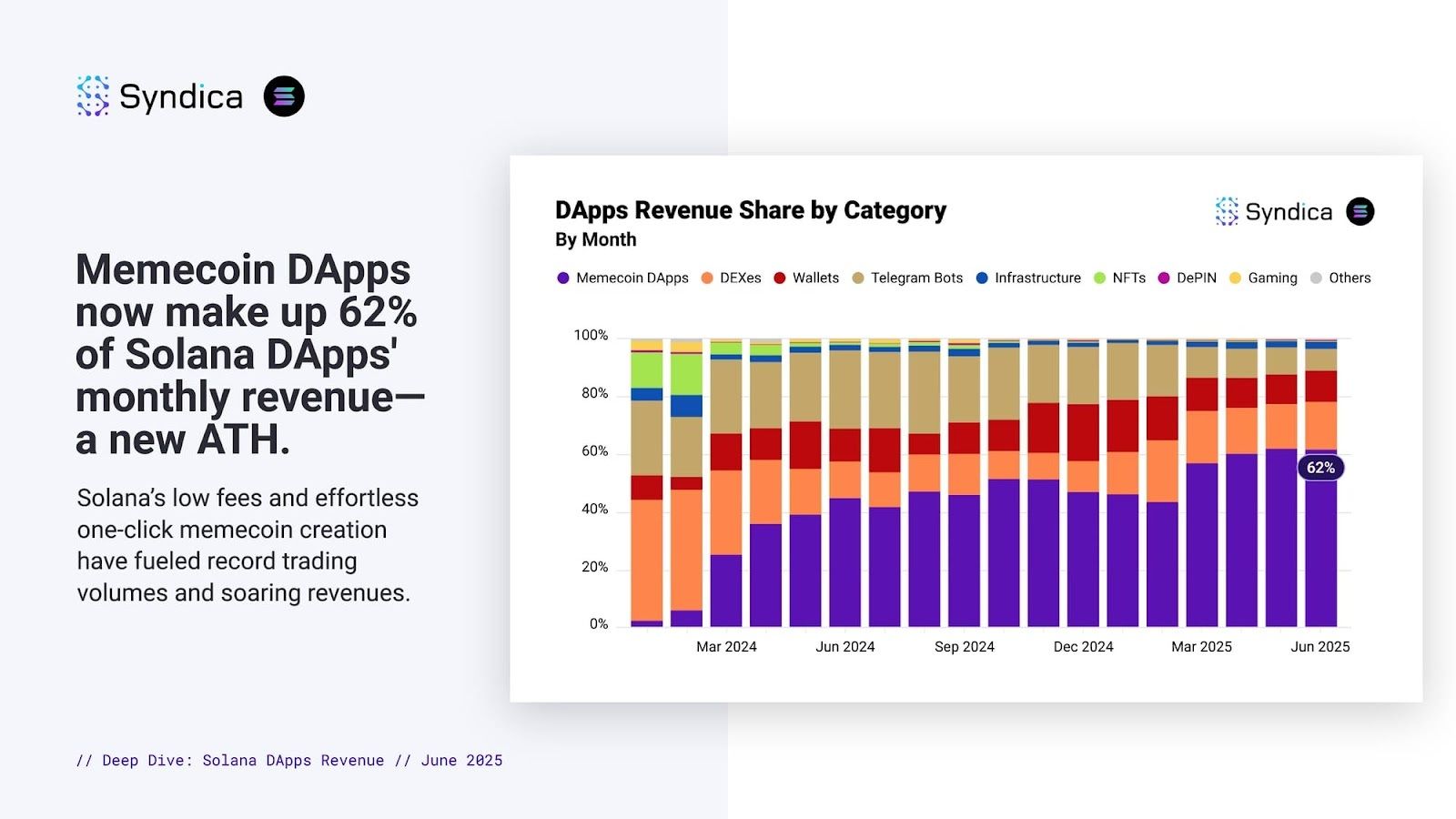

Memecoins accounted for 62% of Solana's decentralized app revenue in June – a new all-time high! The network pulled in $1.6 billion in revenue during the first half of 2025, with the majority driven by memecoin madness through platforms like Pump.fun and PumpSwap. Even newcomer LetBonk is giving Pump.fun a run for its money in the memecoin launchpad race.

Source: Syndica

So basically, Yakovenko is speculated to be in the uncomfortable position of building his empire on what he considers digital junk food.

Solana co-founder called memecoins and NFTs "digital slop" with no intrinsic value, comparing them to exploitative mobile game loot boxesCrypto community backlash erupted over him mocking the user base that drives Solana's successMemecoins generate 62% of Solana's revenue and $1.6B in total H1 2025 earnings, making his criticism awkwardly hypocriticalEyeball Scanner Startup Issues Risky Crypto Loans With 40% Defaults

Divine Research just dropped the crypto equivalent of payday loans – and they're using Sam Altman's eyeball-scanning World ID to make sure you can't ghost them after defaulting! This San Francisco startup has issued around 30,000 unbacked loans since December, proving that sometimes the most questionable ideas are also the most fascinating.

JUST IN: SF lender Divine Research has issued 30,000 unbacked loans since December, using Sam Altman's Worldcoin for borrower ID verification.

— Cryptopolitan (@CPOfficialtx)

7:27 PM • Jul 27, 2025

Divine is handing out sub-$1,000 USDC loans to anyone with internet access and functioning eyeballs. We're talking high-school teachers, fruit vendors, and basically anyone who needs quick cash but can't get it from traditional banks. Founder Diego Estevez calls it "microfinance on steroids," which sounds both exciting and terrifying.

Charge 20-30% interest rates to compensate for the whopping 40% first-loan default rate. That's right – nearly half of borrowers are speculated to peace out without paying back! Divine uses World ID's iris scanning to prevent serial defaulters from creating new accounts.

Divine Research: 30k unsecured crypto loans via World ID iris scans. 40% default rate, 20-30% rates, still profitable. High school teachers & fruit vendors getting USDC without banks. TZNXG watching this space 👁️ tznxg.com#TZNXG#DeFi#CryptoLending#WorldID

— TZNXG (@TZNXG_Global)

4:27 AM • Jul 28, 2025

Everyday investors can fund these high-risk loans for solid returns, with Estevez claiming the system is engineered so "providers will always make a profit" after accounting for defaults. That's some bold math right there! Meanwhile, borrowers get free World tokens that can be "partially reclaimed" – basically a consolation prize for not running away with the money.

Divine isn't alone in this crypto lending renaissance. 3Jane recently raised $5.2 million from Paradigm for uncollateralized Ethereum credit lines, complete with AI agents that automatically enforce repayment.

The timing is believed to be strategic, riding the wave of renewed crypto momentum and political support. Even JPMorgan Chase is reportedly eyeing crypto-backed loans, signaling institutional appetite. But let's not forget the 2022 lending apocalypse when Celsius and Genesis collapsed spectacularly, with Celsius CEO Alex Mashinsky earning himself a 12-year fraud sentence.

Divine Research issued 30K+ unbacked crypto loans using World ID verification, targeting underserved borrowers at 20-30% interest with 40% default ratesGrowing crypto lending sector includes 3Jane ($5.2M Paradigm funding) and Wildcat, capitalizing on renewed market momentumTraditional finance entering space with JPMorgan exploring crypto-backed loans, despite 2022's spectacular lending collapsesSharpLink Buys More ETH Than Network Produced Last Month

SharpLink Gaming just pulled off the crypto equivalent of buying out an entire grocery store – except instead of hoarding toilet paper, they're gobbling up 77,210 ETH worth $295 million! This single purchase is more than all the new Ether issued in the past 30 days (72,795 ETH).

SharpLink(@SharpLinkGaming) bought another 77,210 $ETH($295M) and currently holds 438,017 $ETH($1.69B).

intel.arkm.com/explorer/addre…

— Lookonchain (@lookonchain)

1:24 AM • Jul 28, 2025

The gaming company, now the second-largest corporate ETH holder, isn't playing around with their treasury strategy. Their total stash has ballooned to over 438,000 ETH worth $1.69 billion, and they're staking most of it.

SharpLink just hired Joseph Chalom as co-CEO, a 20-year BlackRock veteran who's believed to be bringing some serious traditional finance firepower to their crypto strategy. This comes after they snagged Consensys CEO Joseph Lubin as board chairman in May.

🚨 JUST IN: Joseph Chalom, BlackRock’s longtime head of digital asset partnerships, has left the firm after 20 years.

He’s now joining SharpLink Gaming, the second-largest Ethereum treasury company.

SharpLink recently added 176,271 $ETH (~$463M) to its balance sheet.

— The Crypto Times (@CryptoTimes_io)

3:18 PM • Jul 25, 2025

The company is speculated to be just getting warmed up. They've filed to increase their stock sale from $1 billion to $6 billion, with the majority earmarked for – you guessed it – more ETH purchases.

BitMine Immersion Technologies holds the crown with 566,000+ ETH worth over $2 billion, and they're targeting an ambitious 5% of ETH's total supply (that's $23 billion worth!). Combined with ETFs, corporations now control 6.73% of all ETH – over $31 billion worth of digital gold just sitting in corporate treasuries.

When companies are buying more ETH than the network can produce, basic economics suggests we're in for some wild price discovery. The question isn't if this creates a supply shock – it's how big the explosion will be when retail investors realize there's barely any ETH left to buy!

SharpLink bought $295M in ETH (77,210 tokens) – exceeding Ethereum's entire 30-day issuance while building a $1.69B crypto treasuryBlackRock veteran Joseph Chalom joins as co-CEO, with company planning $6B stock sale primarily for more ETH purchasesCorporate ETH hoarding accelerates with 6.73% of total supply ($31B+) now controlled by corporations and ETFs, creating potential supply shockDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! 💎 I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). From $16.5 billion chip deals to digital slop drama, today's crypto world served up quite the feast! Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #248

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -