- Proof Of Intel

- Posts

- Paradex's $650K Refund Fiasco, CertiK's IPO Ambitions, SEC's Gemini U-Turn, and Trump's Banking Battle!

Paradex's $650K Refund Fiasco, CertiK's IPO Ambitions, SEC's Gemini U-Turn, and Trump's Banking Battle!

From database disasters to regulatory dismissals, billion-dollar valuations to political charter showdowns, we've got it all!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From Paradex's expensive database oopsie and CertiK's IPO daydreams to the SEC's sudden case-dropping spree and Trump's crypto banking drama, we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of regulatory plot twists and technical faceplants!

INTEL BRIEF

🟧 Paradex refunded $650K to 200 users after a database maintenance glitch caused corrupted market data that triggered unintended liquidations across their derivatives platform.

🟧 CertiK's CEO revealed the blockchain security firm is eyeing a potential IPO at a $2B valuation, which would mark a major milestone for Web3 infrastructure companies.

🟧 The SEC dismissed its civil lawsuit against Gemini with prejudice after the exchange agreed to contribute $40M toward full recovery of Gemini Earn investors' assets lost in the Genesis bankruptcy.

🟧 The OCC rejected Senator Elizabeth Warren's request to pause World Liberty Financial's bank charter application review, stating Trump's involvement won't affect the apolitical evaluation process.

Database Disaster Costs Paradex $650K: The Maintenance Update That Went Horribly Wrong

Paradex just had to cough up a cool $650,000 to roughly 200 users after what can only be described as a maintenance day from hell.

So what happened? Picture this: It's Monday (already a cursed day), and Paradex is running a planned 30-minute database upgrade—you know, routine stuff. Except someone forgot to tell the database about the "routine" part. According to the platform's post-mortem shared on X, a pesky "race condition" decided to crash the party, causing corrupted market data to get written onchain. The result? Unintended liquidations across multiple markets, leaving users watching their positions get nuked faster than you can say "not your keys, not your coins."

To Paradex's credit, they didn't ghost everyone. The team temporarily disabled platform access, canceled all open orders (except take-profit and stop-loss orders because hey, at least let people salvage something), and performed a chain rollback to a snapshot from before things went sideways. Think of it as blockchain's version of Ctrl+Z, except way more expensive.

The good news? This wasn't a hack or security breach—just a good old-fashioned operational faceplant. The better news? Paradex is making users whole with those refunds. Still, this incident joins a growing list of "oops" moments in crypto derivatives trading, reminding us that sometimes the biggest threat isn't hackers—it's the tech itself having a bad day.

Paradex refunded $650K to ~200 users after a database upgrade race condition corrupted market data and triggered unintended liquidationsThe platform rolled back the chain to a pre-maintenance snapshot and canceled open orders to contain the damageThis was an operational failure, not a hack, adding to recent examples of tech glitches disrupting crypto and traditional derivatives marketsCertiK's Billion-Dollar Dreams: Why This $2B Web3 Firm Wants to Go Public

This year's edition gave us a juicy tidbit from CertiK, the blockchain security firm that's basically the bouncer checking IDs at crypto's wildest parties.

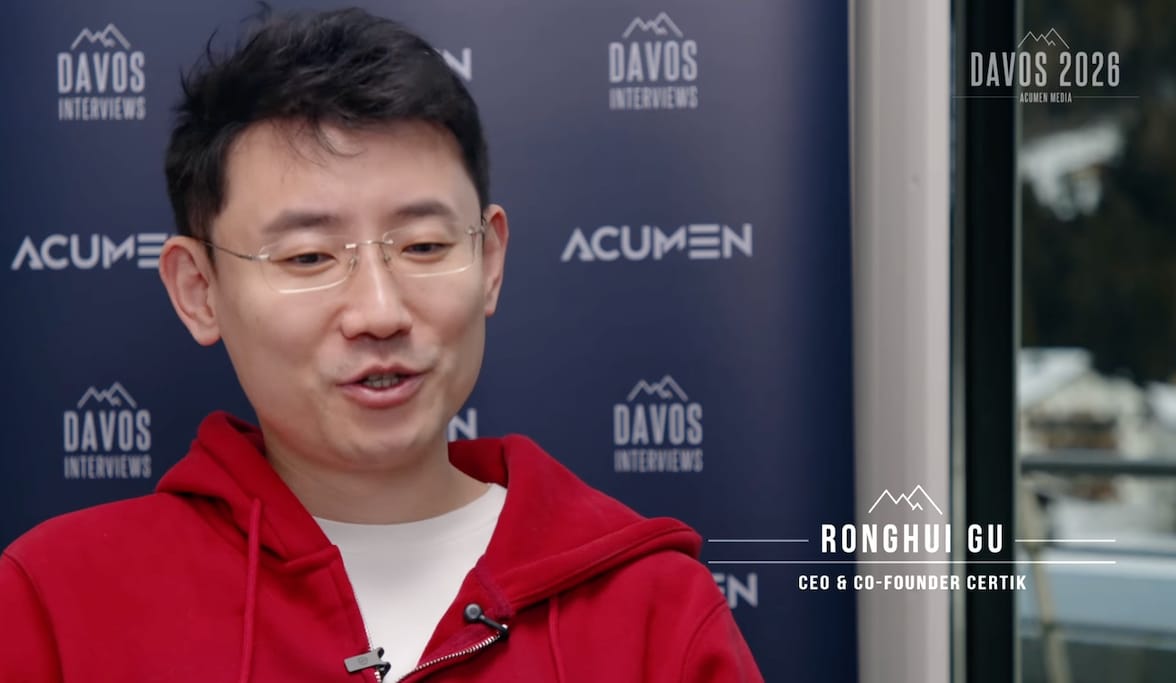

Co-founder and CEO Ronghui Gu dropped some interesting intel during an interview with Acumen Media on Thursday, casually mentioning that CertiK is sitting pretty at a $2 billion valuation and keeping the IPO door ajar—you know, just in case. But before you start refreshing your brokerage app, Gu made it clear this isn't exactly a done deal yet. The company would need "investment, lots of strategic partnerships" to make it happen. Translation: They're interested, but it's complicated.

CertiK co-founder and CEO Ronghui Gu speaking from Davos. Source: Acumen Media

"We still do not have a very concrete IPO plan, but this is definitely the goal we are pursuing," Gu explained, adding that CertiK going public would be huge not just for them, but for the entire Web3 infrastructure space. It's believed to be a potential watershed moment—like when your favorite indie band finally hits the mainstream, except with more smart contract audits and fewer guitar solos.

CertiK isn't alone in eyeing the public markets. The blockchain security firm joins a growing list of crypto companies testing the IPO waters, including Ledger (which is reportedly planning its own listing) and BitGO, which just launched its IPO on Thursday with a valuation north of $2 billion on the NYSE. Coinbase pioneered this path back in 2021, and stablecoin issuer Circle followed suit in June 2025.

So will CertiK join the club? Only time (and probably a lot of paperwork) will tell.

CertiK is valued at $2B and considering a future IPO, though CEO Ronghui Gu says there's no concrete plan yetAn IPO would be significant for Web3 infrastructure companies and require substantial investment and strategic partnershipsCertiK joins BitGO, Ledger, and Circle in the growing list of crypto firms going or planning to go publicGemini Gets Off the Hook: SEC Dismisses Lawsuit After Users Made Whole

US Securities and Exchange Commission just hit the eject button on yet another lawsuit. This time, it's the Gemini Trust Company and Genesis Global Capital getting their "get out of court free" card—dismissed with prejudice, which is legal speak for "we're done here, forever."

According to court filings submitted Friday in the US District Court in the Southern District of New York, both parties filed a joint stipulation to dismiss the SEC's action over Gemini's crypto lending program with Genesis. A federal judge still needs to rubber-stamp the deal, but let's be real—this one's cooked.

Extract of the SEC’s joint stipulation to dismiss the case involving Gemini and Genesis. Source: CourtListener

So why is the SEC suddenly feeling so generous? Well, it turns out they're pretty satisfied with how things shook out. Gemini Earn investors got a 100% in-kind return of their crypto assets through the Genesis bankruptcy case in mid-2024, and Gemini sweetened the pot by agreeing to contribute up to $40 million to help make everyone whole. Genesis also previously settled with the SEC for a $21 million fine, so the agency is believed to have decided that justice has been served (or at least well-funded).

This dismissal comes about nine months after the SEC paused the case in April 2024 when then-acting chairman Mark Uyeda was running the show. The original lawsuit was filed back in January 2023 during the Biden administration's regulatory crackdown blitz, when the SEC was handing out lawsuits like candy on Halloween.

But oh, how times have changed! Gemini now joins an impressive roster of crypto companies that have seen their cases dropped since the Trump administration took office in January 2025 with promises to deregulate the sector—including Binance, Kraken, Uniswap, Immutable, and Robinhood.

The SEC dismissed its civil case against Gemini with prejudice after investors received full recovery and Gemini contributed $40M to the effortGenesis settled separately with a $21M fine, and the case was paused in April 2024 before final dismissal dismissalThis adds to the growing list of dropped crypto cases since the Trump administration began its deregulation push in January 2025Trump's Crypto Bank vs. Elizabeth Warren: OCC Refuses to Hit Pause on WLF Charter

The Office of the Comptroller of the Currency (OCC) just gave Senator Elizabeth Warren a polite but firm "no thanks" to her request to pump the brakes on World Liberty Financial's (WLF) application for a national trust bank charter.

Warren's beef? President Donald Trump and his sons—Eric, Donald Jr., and Barron—are listed as WLF founders, and the platform has speculated to have brought in billions in paper wealth for the fam. She fired off a letter on Jan. 14 demanding the review be paused until Trump divests his stake, because nothing says "conflict of interest" like the President potentially profiting from a regulatory decision.

Extract of Gould’s response to Warren. Source US Senate Banking Committee

But the OCC's Jonathan Gould wasn't having it. In a Friday response, he confirmed that WLF's application will proceed under existing regulatory standards, emphasizing that "no political or personal financial ties will impact the procedural review" of the charter. "The OCC charter application process should be, and under my leadership will be, an apolitical and nonpartisan process," Gould declared, adding that WLF will face the same "rigorous review" as any other applicant.

So what does WLF want with this charter anyway? The company submitted its application on Jan. 7 to expand its crypto operations, specifically to issue, custody, and convert its USD1 stablecoin in-house instead of relying on third-party providers like BitGo. USD1 has already become the sixth-largest stablecoin with a $4.2 billion market cap since launching in March 2025, reportedly being widely used for cross-border payments and treasury operations.

This drama comes as crypto firms are finally catching breaks in the banking world. The OCC granted five conditional approvals in December to Circle, Ripple, Fidelity Digital Assets, BitGo, and Paxos—a signal that TradFi doors are creaking open.

The OCC rejected Warren's request to pause WLF's bank charter review despite Trump family involvement, vowing an apolitical processWLF applied for a charter to issue and custody its USD1 stablecoin in-house, which has reached a $4.2B market cap since March 2025Crypto banking charters are becoming more accessible, with Circle, Ripple, Fidelity, BitGo, and Paxos receiving conditional approvals in DecemberDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). Remember to stay curious, stay informed, and keep your databases properly maintained. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #327

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -