- Proof Of Intel

- Posts

- Prosecutors Lose $48M Bitcoin to Phishing, Trump Sues JPMorgan for $5B, Nasdaq Ditches Crypto Limits, and Capital One Goes Full Stablecoin!

Prosecutors Lose $48M Bitcoin to Phishing, Trump Sues JPMorgan for $5B, Nasdaq Ditches Crypto Limits, and Capital One Goes Full Stablecoin!

In this edition, watch the watchers get hacked, a president wage war on his bank, derivatives go limitless, and traditional finance finally admit crypto is cool – buckle up, it's chaos!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From South Korea's $48 million Bitcoin blunder and Trump's $5 billion banking beef to Nasdaq's options expansion and Capital One's stablecoin shopping spree, we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets!

INTEL BRIEF

🟧 South Korean prosecutors lost $47.7 million in seized Bitcoin to a phishing scam after an agency worker fell for a fake website and leaked access credentials.

🟧 President Trump filed a $5 billion lawsuit against JPMorgan in Florida, claiming the bank debanked him and his businesses without justification following the January 6, 2021 Capitol attack.

🟧 Nasdaq filed with the SEC to eliminate the 25,000-contract position limits on Bitcoin and Ether ETF options, effective immediately, to align crypto derivatives with other commodity-based funds.

🟧 Capital One is acquiring stablecoin-friendly fintech Brex for $5.15 billion in a stock-and-cash deal expected to close mid-2026, marking traditional finance's push into crypto payments.

South Korean Prosecutors Get Phished and Lose $48 Million in Seized Bitcoin

The Gwangju District Prosecutors' Office in South Korea just discovered they're missing around $47.7 million worth of Bitcoin that they had seized from criminals. Talk about irony so thick you could cut it with a blockchain.

During what was probably a very uncomfortable routine inspection, officials realized the Bitcoin had vanished faster than my motivation on a Monday morning. How'd it happen? A good old-fashioned phishing attack. Some unlucky agency worker clicked on a scam website (we've all been there, right? ...right?), and boom—passwords leaked, Bitcoin gone, prosecutors sweating.

For those unfamiliar, phishing is basically the digital equivalent of someone wearing a fake mustache and pretending to be your bank. Attackers create websites or emails that look legit to trick people into handing over their private keys. It's the most common attack in crypto, and apparently, even law enforcement isn't immune.

Here's a silver lining though: Scam Sniffer reported that phishing losses actually dropped over 80% in 2025, falling to $83.85 million, with victims declining nearly 70%. So while this particular heist is embarrassing, the overall trend is improving. Small victories, people.

The prosecutors' office is staying tight-lipped about specifics—when the Bitcoin was seized or exact amounts—citing an ongoing investigation. Translation: they're frantically trying to figure out where it went and how to explain this at the next budget meeting. Meanwhile, this mess comes right after South Korean customs dismantled a major crypto laundering network on Monday. The timing? Chef's kiss levels of unfortunate.

$47.7 million in seized Bitcoin stolen from South Korean prosecutors via phishing scamAgency worker accessed fake website, leaked passwords to attackersInvestigation ongoing; officials not disclosing details about the theft or original seizurePresident Trump Takes JPMorgan to Court Over $5 Billion Debanking Drama

President Donald Trump just filed a $5 billion lawsuit against JPMorgan in a Miami-Dade County court, and the drama is chef's kiss. The president claims the banking giant gave him and his businesses the financial equivalent of a breakup text—terminating accounts "without warning or provocation." JPMorgan's response? Essentially, "new phone, who dis?"

According to a Bloomberg report from Thursday, Trump's complaint wasn't available on the public docket yet (probably still in the printer, honestly), but it's believed to accuse JPMorgan of trade libel and breach of implied covenant of good faith. CEO Jamie Dimon is also named personally for allegedly violating Florida's deceptive trade practices law. A JPMorgan spokesperson fired back saying the lawsuit has "no merit" and that they "do not close accounts for political or religious reasons." Sure, Jan.

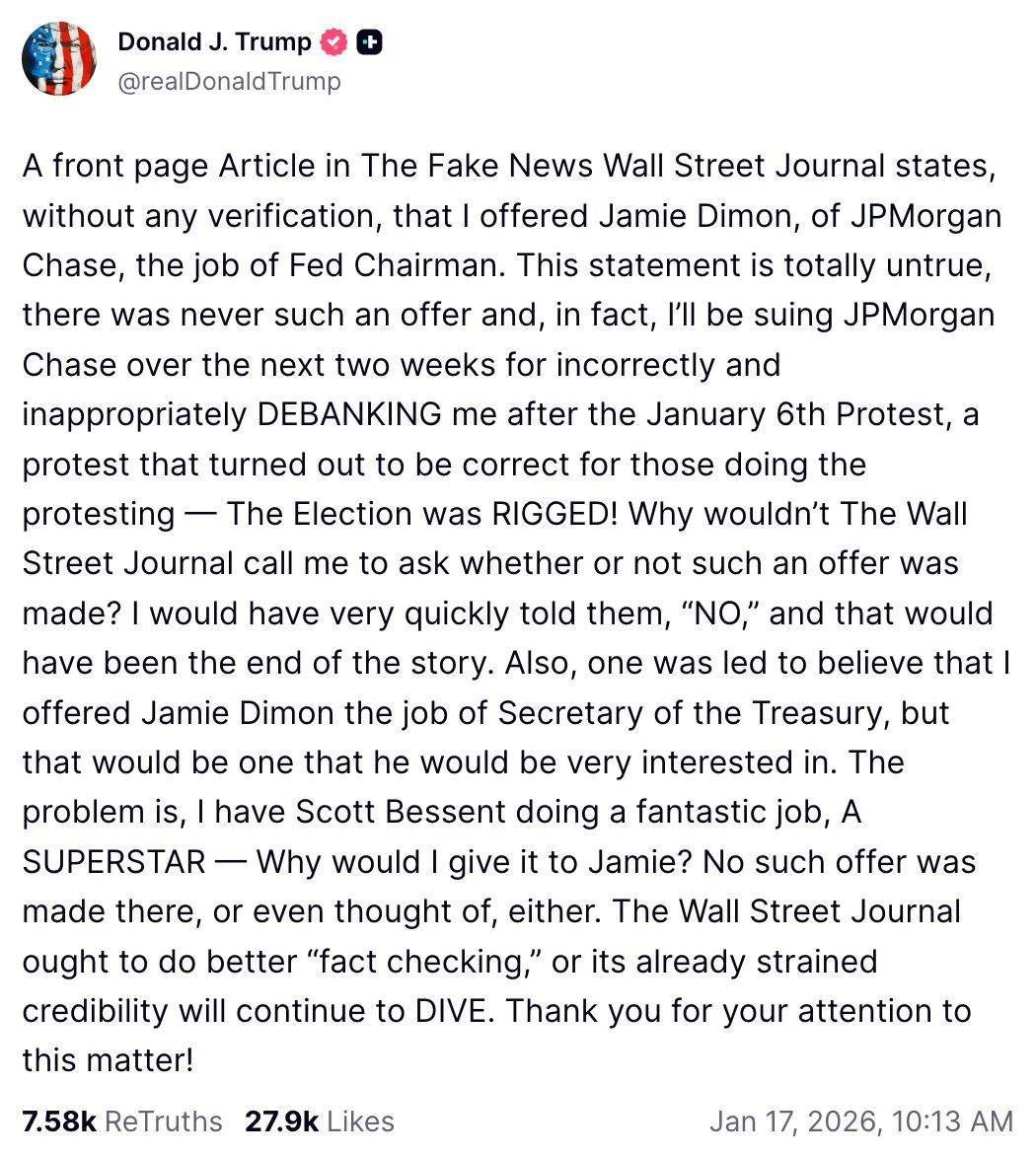

Saturday social media post threatening lawsuit against JPMorgan. Source: Donald Trump

Trump's beef with the bank allegedly stems from account closures in the weeks after his supporters attacked the US Capitol on January 6, 2021. In a January 17 social media post, Trump argued the attack was the "correct" action because the 2020 election was "rigged"—despite losing by 74 electoral votes to Joe Biden. (Math is hard, but not that hard.)

Dimon has previously denied debanking allegations from crypto industry folks too, claiming in December that they've debanked "Democrats... Republicans... different religious folks" but never for those actual reasons. It's giving "I have a friend who..." energy.

This lawsuit comes after Trump signed an executive order in August targeting "politicized or unlawful debanking," ordering regulators to investigate claims and develop preventative measures. Republican lawmakers have been pushing hard on this issue, with some calling for the Senate's market structure bill to address it. The crypto industry has dubbed these debanking claims "Operation Chokepoint 2.0," suggesting a coordinated government effort to cut digital asset businesses off from traditional banking—a movement that gained steam after over 30 tech and crypto executives went public with their own debanking stories in 2024.

Trump sues JPMorgan for $5 billion, claiming unlawful debanking after Jan. 6, 2021JPMorgan denies closing accounts for political or religious reasons; calls lawsuit meritlessLawsuit ties into broader "Operation Chokepoint 2.0" debanking claims in crypto industryNasdaq Just Killed Position Limits on Crypto ETF Options and Traders Are Celebrating

Nasdaq saying "why are we treating crypto like it has cooties?", the exchange just filed a rule change with the SEC to ditch position limits on options tied to spot Bitcoin and Ether ETFs. Translation: the 25,000-contract caps that have been cramping traders' style are officially getting yeeted into the sun.

The proposal, filed January 7 and made effective Wednesday (yes, that fast), removes limits on options for a star-studded lineup of crypto ETFs from BlackRock, Fidelity, Bitwise, Grayscale, ARK/21Shares, and VanEck. The SEC even waived its standard 30-day waiting period, letting this change go live immediately—though they're keeping the option to hit the brakes within 60 days if something feels off.

Nasdaq’s head of digital assets, Matt Savarese, in a November interview. Source: CNBC

For the uninitiated, options are contracts that let traders buy or sell an asset at a specific price before a deadline—kind of like a fancy financial coupon. Exchanges usually cap these to prevent market chaos, manipulation, or that one trader who thinks they're the Wolf of Wall Street. But Nasdaq's arguing that crypto ETF options deserve the same treatment as other commodity-based funds, calling out the unequal treatment while promising investor protection won't take a hit.

The SEC opened a comment period on this, with a final decision expected by late February unless they pump the brakes. This builds on Nasdaq's late 2025 approval to list Bitcoin and Ether ETF options as commodity-based trusts, though those pesky position limits stuck around—until now.

Nasdaq isn't stopping there, either. In November, they filed to raise position limits on BlackRock's iShares Bitcoin Trust (IBIT) from 250,000 contracts to a whopping 1 million, citing growing demand. They're also pushing for tokenized versions of listed stocks and just announced plans with CME Group to unify crypto benchmarks under the snazzy new Nasdaq-CME Crypto Index, tracking heavyweights like BTC, ETH, XRP, Solana, Chainlink, Cardano, and Avalanche.

Nasdaq removes 25,000-contract limits on Bitcoin and Ether ETF options, effective immediatelyChange aligns crypto ETF options with other commodity-based funds to eliminate unequal treatmentPart of Nasdaq's broader push into crypto markets, including tokenized stocks and unified crypto indexesCapital One Drops $5.15 Billion on Brex and Gets a Stablecoin Business in the Deal

Capital One just announced it's buying fintech darling Brex for $5.15 billion, and with it comes the startup's shiny new stablecoin payments solution. This stock-and-cash deal, expected to close by mid-2026, is one of the largest fintech acquisitions in recent years and basically screams "traditional finance wants in on crypto, and they're bringing their checkbook."

Capital One's founder and CEO Richard Fairbank says the acquisition will accelerate their journey into business payments, which is corporate-speak for "we want to be cool like the crypto kids." By folding the stablecoin-friendly Brex into one of the largest US financial institutions, Capital One is making a not-so-subtle bet that stablecoins are here to stay—and they want a front-row seat.

Stablecoins have seen sustained growth while other crypto sectors have declined. Source: CoinGecko

Here's where it gets juicy: back in October, Brex became the first global corporate card provider to offer native stablecoin payments, starting with USDC. That means businesses could pay with stablecoins directly through their corporate cards—no awkward conversions, no weird workarounds. Just smooth, digital dollar vibes.

Brex founder and CEO Pedro Franceschi took to X (formerly Twitter, for the boomers) to reassure everyone he'll keep leading the company post-acquisition. He's framing this as a "growth acceleration" where two founder-led companies team up to serve "millions of businesses in the mainstream US economy" who are allegedly "dramatically underserved by traditional banks." (Shots fired at... traditional banks? In a deal with a traditional bank? The irony is not lost on us.)

The timing couldn't be better. Stablecoins have been the hot topic in TradFi circles since Congress passed key regulations last year. Since the GENIUS Act dropped in July 2025, the stablecoin market cap has jumped 18.6% to a record $314 billion, according to CoinGecko. That's a lot of digital dollars looking for a home, and Capital One just bought itself a first-class ticket to Stablecoin City.

Capital One acquiring Brex for $5.15 billion in stock-and-cash deal, closing mid-2026Brex launched native USDC stablecoin payments in October as first global corporate card providerStablecoin market cap hit record $314 billion since GENIUS Act regulations passed in July 2025Do you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #326

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -