- Proof Of Intel

- Posts

- Trump Threatens 50% Tariffs Over Brazil's Pix, Ex-Rugby Star Gets Prison for $900K Crypto Scam, SharpLink Hunts 1% of All ETH, and Claude Code Users Revolt!

Trump Threatens 50% Tariffs Over Brazil's Pix, Ex-Rugby Star Gets Prison for $900K Crypto Scam, SharpLink Hunts 1% of All ETH, and Claude Code Users Revolt!

In this edition, Mochi serves up international payment drama, crypto fraud fumbles, corporate ETH hoarding, and AI service surprises – navigating the tech chaos, one byte at a time!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From the US taking aim at Brazil's Pix payment system and rugby player Ponzi schemes, to SharpLink Gaming's epic ETH shopping spree and Anthropic's sneaky usage limit changes, we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets!

INTEL BRIEF

🟧 The US launches a formal trade investigation into Brazil's Pix payment system amid concerns it's disadvantaging American financial companies and contributing to broader efforts to bypass US-dominated financial infrastructure.

🟧 Former rugby player Shane Donovan Moore gets 2.5 years in federal prison for running a $900,000 crypto mining Ponzi scheme that defrauded over 40 investors with promises of 1% daily returns.

🟧 SharpLink Gaming expanded its share offering from $1 billion to $6 billion to buy more Ethereum, potentially acquiring nearly 1.4% of ETH's total supply while becoming the largest corporate ETH holder.

🟧 Anthropic quietly tightened usage limits for Claude Code users without warning, causing confusion and frustration among subscribers who are hitting unexpectedly restrictive caps on their $200/month Max plans.

US Launches Trade War Against Brazil Over Digital Payment Success

Brazil's instant payment darling Pix has caught the attention of the US government, and let me tell you, they're not exactly sending love letters. The US Trade Representative Jamieson Greer just launched a formal investigation into Brazil's digital trade practices, with Pix sitting pretty at the center of this diplomatic drama.

US launches probe into Brazil's trade practices, digital payment services

— Reuters (@Reuters)

11:45 AM • Jul 16, 2025

Pix is Brazil's government-run instant payment system that's been absolutely crushing it since 2020. We're talking 150 million users and acceptance at over 60 million businesses - basically, it's become Brazil's financial backbone.

The investigation isn't just about Pix being too successful (though that's definitely part of it). The US is speculated to be concerned about Brazil giving preferential treatment to other trade partners while leaving American companies like Mastercard and Visa.

Brazil doesn't kneel - Trump is pressing 🇧🇷 because we have PIX, instantaneous way of payment: you transfer via bank app on mobile phone between 2 parties (person to person or person to institution) in mere seconds almost instantaneously. VISA & Mastercard are losing money here!

— Baron Zaraguin (@BaronZaraguin)

12:34 AM • Jul 18, 2025

The plot thickens when you consider that Trump has already threatened Brazil with a whopping 50% tariff on imports, apparently as a "friendly reminder" that America doesn't appreciate being sidelined. And let's not forget the whole X (formerly Twitter) suspension drama from August 2024, where Elon Musk's refusal to play by Brazil's rules led to a nationwide platform ban.

Pix might be domestic-only, but it's part of Brazil's broader BRICS strategy to reduce dependence on US financial infrastructure. With crypto-fintech bridges enabling global stablecoin settlements through Pix, suddenly America's traditional payment rails are looking a bit... lonely.

US launches formal investigation into Brazil's Pix payment system for allegedly disadvantaging American financial companiesTrump threatens 50% tariff on Brazilian imports as tensions escalate over digital payment policiesPix's success (150M users, 60M businesses) is seen as part of broader BRICS effort to bypass US-dominated financial systemsRugby Player Sentenced to Prison for $900K Crypto Mining Scam

Former rugby player Shane Donovan Moore just traded his jersey for an orange jumpsuit after being sentenced to 2.5 years in federal prison for running what can only be described as the most predictable crypto scam playbook ever written.

Former rugby player sentenced to 30 months for running a $900K crypto Ponzi scheme.

He exploited his rugby community, promising daily profits from nonexistent crypto mining. Like many Ponzi schemes, he made small payouts to early investors, creating a false sense of legitimacy

— Web3 Antivirus (@web3_antivirus)

1:25 PM • Jul 18, 2025

Our rugby-turned-rugpull hero operated Quantum Donovan LLC from January 2021 to October 2022, where he allegedly convinced over 40 investors to hand over more than $900,000 with promises that would make even the most gullible crypto enthusiast raise an eyebrow. A whopping 1% daily return on crypto mining investments.

Moore reportedly went full "Wolf of Wall Street" mode. We're talking luxury apartments, designer luggage, and electronics - basically everything except the mining rigs he promised to buy.

Acting US Attorney Teal Luthy Miller perfectly summarized the situation. "Mr. Moore used the newness of cryptocurrency to commit an age-old fraud — a Ponzi scheme."

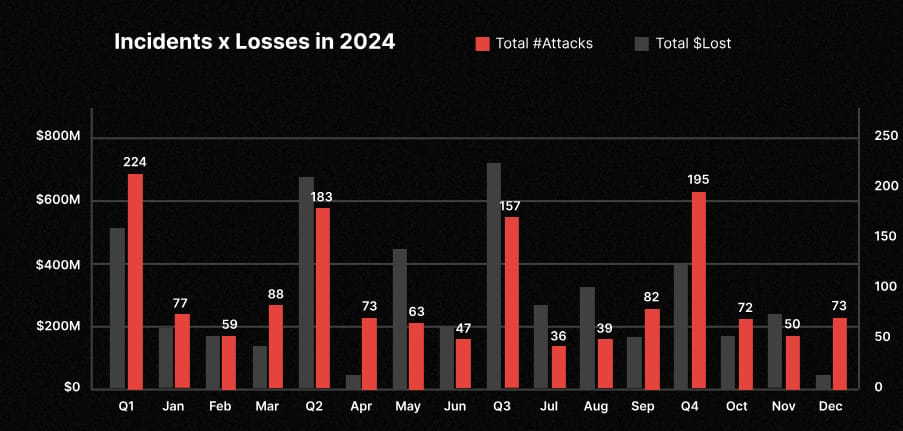

Incidents and losses in 2024 by month. Source: Certik

Moore leveraged his rugby connections to find victims, proving that even sports camaraderie isn't safe from crypto scammers. US District Judge Tana Lin noted that he caused "emotional and psychological damage" beyond just the financial losses.

Shane Donovan Moore sentenced to 2.5 years for $900K crypto mining Ponzi scheme targeting rugby communityPromised 1% daily returns but spent investor money on luxury lifestyle instead of mining equipmentLatest in string of crypto Ponzi schemes as scammers continue exploiting crypto's "newness" for old-school fraudSharpLink Gaming Expands to $6B Stock Offering to Buy More Ethereum

SharpLink Gaming just went from "we like ETH" to "we want to BE ETH" in the most spectacular way possible! This Joseph Lubin-backed company just cranked their equity offering from a modest $1 billion to a absolutely bonkers $6 billion.

The @ethereumJoseph-led Ethereum Treasury Company @SharpLinkGaming just filed to increase their stock sale to $6 BILLION from $1 BILLION to buy more $ETH and you're not bullish?

— Zack Guzmán (@zGuz)

9:44 PM • Jul 17, 2025

SharpLink actually uses that full $6 billion to buy ETH at today's prices, they'd own nearly 1.38% of Ethereum's entire circulating supply.

The company isn't messing around either. They've already scooped up $515 million worth of ETH in just the past nine days, bringing their total stash to over 280,000 ETH (with a whopping 99.7% of it staked because why not earn while you HODL?). They're believed to be eyeing that magical 1 million ETH target, which would make them the undisputed corporate ETH champion.

While SharpLink is going absolutely ham on ETH purchases, their stock (SBET) is having a bit of a rough time. The stock dropped 2.62% on Thursday and is down 54% from its May high of $79.21.

SharpLink(@SharpLinkGaming) bought another 32,892 $ETH($115M) in the past 3 hours.

In the past 9 days, they've accumulated 144,501 $ETH($515M).

— Lookonchain (@lookonchain)

1:16 AM • Jul 18, 2025

Galaxy Research is calling this move a "positive catalyst" for the Ethereum ecosystem, and honestly, when you're buying ETH, you're probably doing something right. The company even generated 415 ETH (worth $1.49 million) in staking rewards between June and July - because apparently making money while hodling is the new black.

SharpLink expanded share offering to $6 billion to buy more ETH, potentially acquiring 1.4% of total supplyCompany already holds 280,000+ ETH and bought $515M worth in just 9 days, becoming largest corporate holderStock down 54% from May highs despite aggressive ETH accumulation strategy and 350% YTD gainsAnthropic Secretly Cuts Claude Code Usage Limits Sparking User Outrage

Anthropic just pulled a classic "change the rules mid-game" move that's got Claude Code users more confused than a chameleon in a bag of Skittles! Since Monday morning, users have been getting slapped with unexpectedly restrictive usage limits.

Anthropic tightens usage limits for Claude Code – without telling users | TechCrunch

— TechCrunch (@TechCrunch)

9:09 PM • Jul 17, 2025

The drama is particularly spicy for users on the $200-a-month Max plan (yes, you read that right, two hundred dollars!), who are suddenly hitting walls. Users are getting the oh-so-helpful message "Claude usage limit reached" with zero context about what changed or why their supposedly premium service is now acting.

"There is no way in the 30 minutes of a few requests I have hit the 900 messages." And honestly, when you're paying $200 a month and can't even get through your morning coffee routine without hitting limits, something's definitely not adding up!

Anthropic's response has been about as transparent as a brick wall. Their representative basically said "we're aware some users are experiencing slower response times.” Meanwhile, their status page is showing six separate issues in four days while somehow maintaining 100% uptime.

Paying Claude Code subscribers, especially on the Max plan, are encountering unexpected usage limits, sparking frustration over Anthropic's vague pricing and lack of communication.

#ClaudeCode#AnthropicAI#UsageLimits#AITools#PricingTransparency

— Gray Hats (@the_yellow_fall)

9:50 AM • Jul 18, 2025

The $200 Max plan might have been too generous for Anthropic's bottom line. One user mentioned making over $1,000 worth of API calls daily - which means Anthropic was essentially subsidizing power users' AI addiction. The sudden crackdown suggests the company realized their pricing model was more "loss leader" than "profit maker."

The lack of communication is what's really grinding users' gears though. As one user put it: "Just be transparent. The lack of communication just causes people to lose confidence in them."

Anthropic quietly tightened Claude Code usage limits without warning users, causing confusion and frustration$200/month Max plan subscribers hit unexpected caps despite paying premium prices for higher limitsCompany's lack of transparency about changes is eroding user confidence while network shows multiple issuesDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). From international payment wars to crypto scams and AI service hiccups, today's tech landscape certainly keeps us on our toes! Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #243

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -