- Proof Of Intel

- Posts

- UK Reverses Crypto Ban, Trump Terrorizes the Fed, Hashgraph Takes on Worldcoin, and Instagram Kills Small Creators!

UK Reverses Crypto Ban, Trump Terrorizes the Fed, Hashgraph Takes on Worldcoin, and Instagram Kills Small Creators!

In this edition, Mochi serves up regulatory reversals, central bank drama, digital identity battles, and social media gatekeeping – navigating the tech turbulence, one byte at a time!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. From the UK's regulatory U-turn on crypto ETNs and Fed drama worthy of a Netflix series to blockchain identity wars and Instagram's follower gatekeeping, we've got a lot to unpack. So, buckle up and get ready for a wild ride through the wonderland of digital assets and tech mayhem!

INTEL BRIEF

🟧 The UK's FCA has reversed its 2021 ban on crypto ETNs for retail investors, allowing access starting October 8th while keeping crypto derivatives restricted.

🟧 Fed Board member Adriana Kugler resigned effective August 8th amid growing political pressure from Trump, who continues challenging Fed independence and criticizing Jerome Powell's leadership.

🟧 The Hashgraph Group launched IDTrust, a blockchain-based self-sovereign identity platform on Hedera network, positioning it as a competitor to Worldcoin and Microsoft with enhanced user data control.

🟧 Instagram now requires users to have public accounts with at least 1,000 followers to go live, ending the platform's previous policy of allowing anyone to livestream.

UK Says Cheerio to Crypto ETN Ban as Retail Investors Get Welcome Back to the Party

The UK's Financial Conduct Authority (FCA) has officially lifted the ban on crypto exchange-traded notes (ETNs) for retail investors, effective October 8th.

Remember back in January 2021 when the FCA basically told retail investors to "bugger off" from crypto ETNs, citing extreme volatility and claiming there was a "lack of legitimate investment need"?

🇬🇧 JUST IN: UK’s financial regulator FCA lifts ban on crypto ETNs for retail investors, allowing access via UK-approved exchanges.

— Cointelegraph (@Cointelegraph)

12:00 PM • Aug 1, 2025

David Geale, the FCA's executive director of payments and digital finance, essentially admitted they were being a bit overly protective back then, stating that "the market has evolved, and products have become more mainstream and better understood."

Now, before you get too excited and start planning your yacht purchases, let's clarify what crypto ETNs actually are. Unlike ETFs that hold actual crypto assets like a digital piggy bank, ETNs are debt securities – think of them as fancy IOUs backed by crypto collateral.

Differences between ETFs, ETCs [exchange-traded commodities] and ETNs. Source: Bitpanda

ETNs are getting the green light, crypto derivatives are still persona non grata. The FCA is apparently taking a "one step at a time" approach, keeping futures and options locked away like the Crown Jewels.

Meanwhile, across the pond, the US crypto ETF market continues its victory lap with BlackRock posting a 370% surge in Q2 2025 inflows. The SEC even approved in-kind redemptions, though analysts are calling it more of a "plumbing fix" than a retail game-changer.

UK retail investors can now access crypto ETNs starting October 8th after a 4-year banCrypto derivatives remain forbidden – the FCA is taking baby stepsETNs are debt securities, not actual crypto holdings, offering indirect exposure through traditional brokersFed Board Member Bails as Trump Turns Up the Heat on Central Bank Independence

Federal Reserve Board member Adriana Kugler has officially thrown in the towel, announcing her resignation effective August 8th.

Federal Reserve’s Kugler to resign, giving Trump earlier-than-expected opening

— POLITICO (@politico)

7:49 PM • Aug 1, 2025

Kugler, who was supposed to stick around until January, is heading back to Georgetown University. While she's being diplomatically vague about her reasons.

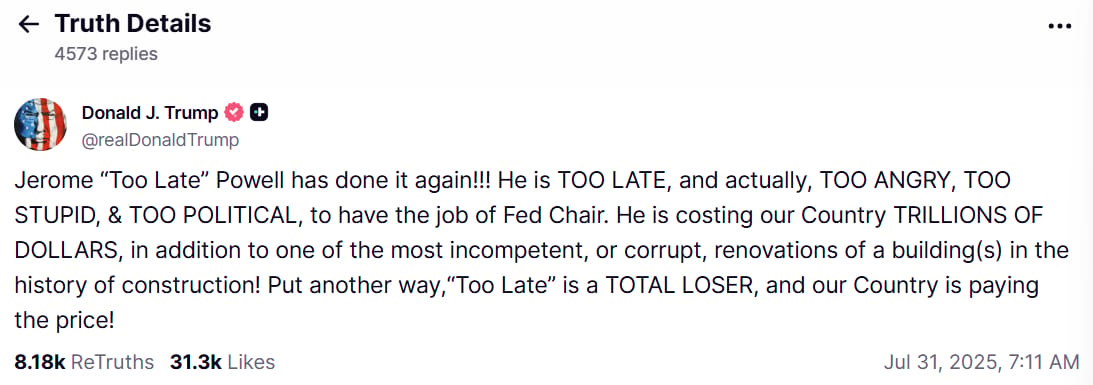

The resignation comes as President Trump continues his relentless campaign against Fed Chair Jerome Powell, essentially treating the central bank like his personal interest rate DJ. Trump's recent Truth Social rant about Powell "refusing to lower the Fed rate" has all the subtlety of a sledgehammer at a tea party. He even floated the idea of appointing himself to the Fed.

Source: Truth Social

Kugler was a voting member of the FOMC, the 12-person committee that decides whether your mortgage payments go up or down. Her departure gives Trump a golden opportunity to appoint someone more aligned with his "cut rates, cut them now!" philosophy.

The crypto world is watching nervously as this Fed soap opera unfolds. Bitcoin has been doing the monetary policy tango, rejecting at $116K despite stronger jobs data, as traders try to decode when (or if) rate cuts are coming. With 75% of bets now favoring cuts, the market is basically playing Fed roulette.

It's official:

President Trump is now calling for the first 300+ basis point interest rate cut in US history.

This would be 3 TIMES larger than the 100 bps cut on March 15th, 2020, the largest in history.

So, what happens if the Fed does this? Let us explain.

(a thread)

— The Kobeissi Letter (@KobeissiLetter)

3:20 PM • Jul 9, 2025

Trump's unprecedented interference in Fed operations is breaking decades of tradition. The question now is whether Powell can weather this political storm or if he'll be the next to pack his bags.

Fed Board member Adriana Kugler resigned amid Trump's intensifying pressure on Fed independenceTrump continues attacking Jerome Powell and floating the idea of appointing himself to the FedKugler's departure gives Trump an opportunity to appoint a more rate-cut-friendly replacementSwiss Startup Launches IDTrust to Challenge Worldcoin and Microsoft in Digital Identity Battle

The Hashgraph Group (THG) just threw their hat into the digital identity ring with IDTrust, a shiny new self-sovereign identity platform that's supposedly going to make Worldcoin and Microsoft Entra.

Built on the Hedera network and powered by AI (because apparently everything needs AI these days, even your digital passport), IDTrust is positioning itself as the Swiss Army knife of identity solutions. Co-founder and CEO Stefan Deiss is basically saying "We're not like other SSI platforms, we're cool SSI platforms" – and honestly, he might have a point!

🚨Breaking: This Could be HUGE

For $HBAR@Cointelegraph reports:

Hedera-powered self‑sovereign digital identity platform launched by Hashgraph Group

Here’s why it’s a big deal:

- IDTrust leverages Hedera Consensus Service with a stateless proof mechanism for efficiency and

— Mark (@markchadwickx)

3:45 PM • Aug 1, 2025

It uses Hedera's Consensus Service stateless proof mechanism, which Deiss claims is more efficient than those blockchain heavyweights Polygon and Ethereum. While other networks are busy carrying around their entire transaction history like digital pack rats, IDTrust travels light and doesn't burden validators.

THG is positioning against the competition. They're basically saying Worldcoin is great if you just want to prove you're human (thanks, Sam Altman!), but IDTrust offers the full enchilada – authentication AND authorization. Meanwhile, Microsoft Entra is getting the side-eye for being too centralized, while IDTrust promises users complete control over their personal data.

$HBAR Hedera Hashgraph Robinhood

🧨 BREAKING NEWS🧨

The Hashgraph Group (THG) has launched IDTrust, a self-sovereign identity (SSI) platform built on Hedera, empowering users to control and verify digital credentials securely.

Leveraging Hedera’s high-throughput, low-latency

— Crypto Observer (@DJ_Bax01)

12:54 AM • Aug 2, 2025

Switzerland is rolling out its national e-ID initiative, and THG – being Swiss-based – is already cozying up to government authorities. Deiss mentioned they'll be compatible with Swiss Verifiable Credentials, allowing users to mix and match digital proofs.

With governments worldwide rushing toward digital identity solutions (Vietnam just launched their own blockchain platform), IDTrust is betting that decentralization will trump centralized control.

THG launched IDTrust, a self-sovereign identity platform on Hedera network targeting Worldcoin and MicrosoftPlatform offers full user data control and doesn't burden network validators like Ethereum/Polygon solutionsSwiss timing is strategic as the country develops national e-ID initiative compatible with IDTrustInstagram Betrays Small Creators by Requiring 1000 Followers to Go Live

Instagram just pulled a classic corporate move! The platform has officially slammed the door on smaller creators by implementing a new requirement: you need at least 1,000 followers AND a public account to go live.

Instagram now requires users to have at least 1,000 followers to go live | TechCrunch

— TechCrunch (@TechCrunch)

2:06 PM • Aug 1, 2025

This brutal policy shift means that countless smaller creators who were just starting their journey are now locked out of one of Instagram's most engaging features. Gone are the days when you could randomly decide to broadcast your terrible cooking attempts or late-night philosophical rants to your handful of loyal friends. Meta basically said "size matters" and smaller accounts got the boot!

The timing is particularly savage considering this aligns Instagram with TikTok's 1K requirement, while YouTube only asks for a measly 50 subscribers. Meanwhile, users are flooding social media with complaints.

Instagram restricts live broadcasts to users with a public account and at least 1,000 followers.

By comparison, TikTok also requires users to have 1,000 followers to access live streaming, whereas YouTube allows users to go live with just 50 subscribers.

— Egline Samoei (@Egline_Samoei)

10:10 AM • Aug 1, 2025

They claim it's to "improve the overall Live consumption experience" – which is corporate speak for "we're tired of hosting streams where three people watch someone eat cereal." Hosting livestreams is expensive as heck, and Meta probably got tired of burning cash on broadcasts that barely register a blip on their engagement radar.

This move is a double-edged sword for the platform. Sure, it might eliminate some lower-quality content and save Meta some serious server costs, but it's also alienating the very creators who could become tomorrow's influencers. Nothing says "we believe in growing creators" quite like putting up a 1,000-follower paywall!

The backlash has been swift and merciless, with users demanding the change be reversed. But knowing Meta's track record, they'll probably double down and add even more restrictions next week!

Instagram now requires 1,000+ followers and public accounts for live streaming accessChange aligns with TikTok but is stricter than YouTube's 50-subscriber requirementMove likely cuts costs for Meta while potentially stifling smaller creator growthDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe even a little bit richer (in knowledge, of course). From regulatory plot twists to corporate power plays, today's tech landscape is serving up more drama than a reality TV show! Remember to stay curious, stay informed, and keep spreading the love. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #253

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -