- Proof Of Intel

- Posts

- Xiaomi Cryptofies Millions of Phones, Do Kwon Gets 15 Years Behind Bars, Wall Street Goes Full Blockchain, and Google Crashes OpenAI's Launch Party!

Xiaomi Cryptofies Millions of Phones, Do Kwon Gets 15 Years Behind Bars, Wall Street Goes Full Blockchain, and Google Crashes OpenAI's Launch Party!

From millions of pre-installed wallets to SEC green lights, prison sentences to passive-aggressive product launches, we've got it all!

Hey there, PoI readers! 💫

It's your favorite crypto connoisseur, Mochi, back with another serving of tantalizing tech and web3 news. Today's menu is packed: Xiaomi's flooding millions of phones with crypto wallets, Do Kwon's learning that fraud comes with a 15-year timeout, Wall Street's getting the blockchain makeover courtesy of the SEC and DTCC, and Google and OpenAI are having the pettiest product launch showdown in AI history. So grab your favorite beverage, settle in, and let's dive into this digital feast!

INTEL BRIEF

🟧 Xiaomi is pre-installing Sei's crypto wallet on millions of smartphones globally, marking one of the biggest mainstream mobile crypto distribution deals to date.

🟧 Do Kwon, Terraform Labs co-founder, was sentenced to 15 years in prison for his role in the $40 billion Terra collapse that devastated thousands of investors.

🟧 The SEC granted DTCC's subsidiary a no-action letter to tokenize major US securities including stocks, ETFs, and Treasurys starting in 2026.

🟧 Google launched its upgraded Gemini Deep Research agent powered by Gemini 3 Pro on the exact same day OpenAI released GPT-5.2, sparking an epic AI showdown.

Xiaomi Is About to Make Crypto Wallets as Common as Calculator Apps

Xiaomi is about to flood the market with crypto wallets whether you asked for one or not. In a move that's either brilliantly forward-thinking or delightfully chaotic, Sei Labs has partnered with the electronics giant to pre-install a crypto wallet and discovery app on every Xiaomi phone sold outside mainland China and the US.

Starting in Europe, Latin America, Southeast Asia, and Africa, millions of unsuspecting phone buyers will find themselves one tap away from the crypto rabbit hole. The app lets users sign in with their Google or Xiaomi IDs (because apparently, we needed another reason to use those accounts), and features a multiparty computation wallet for security—fancy talk for "we really, really don't want you getting rekt."

Xiaomi’s “Lens to Legend” smartphone. Source: Xiaomi

But wait, there's more! The partnership isn't just about wallets gathering digital dust. Sei Labs is throwing $5 million at developers to build mobile blockchain projects, and by mid-2026, they're planning to let you buy Xiaomi products—yes, including electric vehicles—with stablecoins like USDC. Hong Kong and the EU are reportedly getting first dibs on this stablecoin shopping spree.

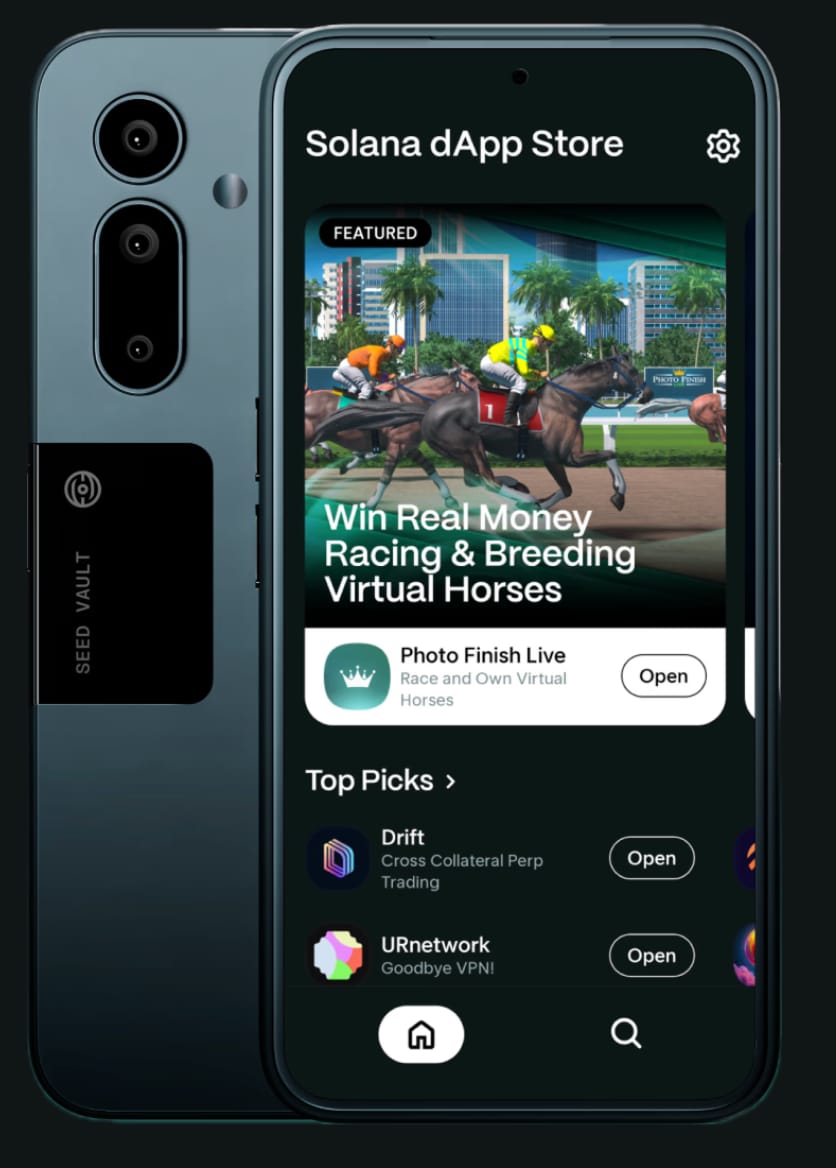

Source: Solana Mobile

For context, Sei is a high-speed layer-1 blockchain launched in 2023, designed for low-cost transactions. Xiaomi, founded in 2010, is a Beijing-based behemoth making everything from smartphones to smart-home gadgets to EVs. Together, they're betting that pre-installed crypto access could be the nudge mainstream users need to finally embrace Web3.

Whether this turns millions into crypto enthusiasts or just adds another app to the "ignore forever" folder remains to be seen. But one thing's certain: crypto just got a whole lot more accessible.

Xiaomi is pre-installing Sei's crypto wallet on all phones sold outside China and the US across Europe, Latin America, Southeast Asia, and AfricaStablecoin payments for Xiaomi products (phones, EVs) launching in Hong Kong and EU by mid-2026$5 million fund created to support mobile blockchain projectsDo Kwon Just Got 15 Years for Turning Billions into Digital Dust

Do Kwon, the co-founder of Terraform Labs, just learned that collapsing a $40 billion ecosystem comes with a hefty prison sentence: 15 years behind bars.

In a Thursday hearing at the US District Court for the Southern District of New York, Judge Paul Engelmayer handed down the sentence after Kwon pleaded guilty to wire fraud and conspiracy to defraud. Before deciding, the judge spent hours listening to victims describe how Terra's 2022 implosion absolutely wrecked their lives. One victim, Tatiana Dontsova, reportedly told the court she sold her Moscow apartment to invest with Kwon—$81,000 turned into $13—and is now officially homeless. Ouch doesn't even begin to cover it.

Kwon, who spent 17 months fighting extradition from Montenegro before finally being handed over to US authorities in December 2024, apparently used his pre-sentencing moment to reflect. "I have spent all my time thinking what I could have done," he said, adding that he'd like to "do his penance" back home in South Korea. (Spoiler: he might get that chance, but with an additional 40 years of prison time waiting for him there.)

Judge Engelmayer wasn't having any of Kwon's remorse act. "Your fraud was unusually serious," he said, noting that Kwon publicly lied to the market for four years. The judge rejected both the prosecution's 12-year recommendation (too lenient) and the defense's five-year request (laughably low), warning future crypto fraudsters: "You will lose your liberty for a long time."

The cherry on top? Kwon could be extradited to South Korea after serving just seven and a half years in the US, where he'll face even more legal troubles. Prosecutors estimate 16,500 victims were affected by Terraform's collapse.

Do Kwon now joins crypto's rogues' gallery alongside Sam Bankman-Fried (25 years), Alex Mashinsky (12 years), and formerly CZ—who was pardoned by President Trump after serving four months.

Do Kwon sentenced to 15 years in US prison for wire fraud and conspiracy related to Terra's $40 billion collapseJudge called his fraud "unusually serious" after hearing from victims, one of whom lost her home and is now homelessCould face an additional 40 years in South Korea after serving half his US sentenceWall Street Can Finally Tokenize Your Stocks Thanks to the SEC

US Securities and Exchange Commission just gave Wall Street's infrastructure overlord permission to tokenize securities. Yes, you read that right—actual stocks, ETFs, and US Treasurys are about to get the blockchain treatment.

The Depository Trust and Clearing Corporation (DTCC)—aka the mega-institution that handles clearing, settlement, and trading for basically all US securities—announced Thursday that its subsidiary, the Depository Trust Company (DTC), received a coveted "no-action" letter from the SEC. Translation: the agency won't come after them for launching a tokenization service, as long as they stick to the plan.

Starting in the second half of 2026, the DTC will tokenize "highly liquid assets" including the Russell 1000 index, major ETFs, and US Treasury bills, bonds, and notes. The tokenized versions will reportedly have all the same entitlements, investor protections, and ownership rights as traditional securities—except now they're programmable, accessible 24/7, and way more mobile.

"Tokenizing the US securities market has the potential to yield transformational benefits," said DTCC CEO Frank La Salla, who is probably still pinching himself that this is actually happening. We're talking collateral mobility, new trading modalities, and programmable assets—basically everything the crypto community has been screaming about for years.

The SEC's no-action letter is valid for three years and allows the DTC to offer tokenization services on pre-approved blockchains for DTC participants and their clients. It's worth noting that SEC Chair Paul Atkins, a former crypto lobbyist, has been notably warmer to the industry than his predecessor. Over recent months, the SEC has handed out no-action letters to DePIN projects and cleared investment advisers to use state trust companies as crypto custodians.

This isn't just a win for crypto—it's Wall Street officially embracing blockchain infrastructure. Buckle up.

SEC gave DTCC a no-action letter to tokenize major US securities including Russell 1000 stocks, ETFs, and US TreasurysService launching in second half of 2026 with tokenized assets having same rights as traditional securitiesValid for three years on pre-approved blockchains, marking Wall Street's official embrace of tokenizationGoogle Tried to Steal OpenAI's Thunder and It Was Gloriously Petty

Nothing says "we're totally not threatened by our competitors" like dropping a major product announcement on the exact same day your biggest rival launches their flagship model. Welcome to Thursday's AI cage match, where Google unleashed its "reimagined" Gemini Deep Research agent literally hours before OpenAI debuted GPT-5.2 (codenamed "Garlic," because apparently AI models need food-based aliases now).

Google's new toy is powered by Gemini 3 Pro, which the company claims is its "most factual" model trained to minimize hallucinations—those delightful moments when AI just straight-up invents information. This is supposedly crucial for deep reasoning tasks where one hallucinated decision can torpedo an entire multi-hour research project. The agent can now be embedded into apps via Google's new Interactions API, and will reportedly be integrated into Google Search, Google Finance, the Gemini App, and NotebookLM. Translation: Google is preparing for a future where humans don't search anything—their AI agents do it for them.

To prove they're winning (narrator: they needed to prove it), Google created yet another benchmark called DeepSearchQA. They also tested Deep Research on the magnificently named "Humanity's Last Exam" and BrowserComp. Results? Google's agent topped its own benchmark and Humanity's Last Exam, though OpenAI's ChatGPT 5 Pro came in a surprisingly close second and actually beat Google on BrowserComp.

But here's the kicker: those benchmarks were obsolete almost immediately. Because OpenAI dropped GPT-5.2 the same day, claiming their newest model bests rivals—especially Google—on a suite of typical benchmarks, including OpenAI's homegrown ones.

The timing? Absolutely not a coincidence. Google knew the world was waiting for Garlic and decided to crash the party with their own announcement. It's the tech equivalent of showing up to your ex's wedding in a better outfit. Peak pettiness, maximum entertainment.

Google launched upgraded Gemini Deep Research powered by Gemini 3 Pro with new Interactions API for developersOpenAI dropped GPT-5.2 ("Garlic") the same day, claiming superiority over Google on key benchmarksBoth companies trading blows with competing benchmark results in the world's most passive-aggressive product launchDo you want to be added to the upcoming Proof of Intel Group Chat, where readers get live insights as they happen and more? |

And that's a wrap, my lovely PoI readers! I hope this edition left you feeling informed, entertained, and maybe slightly concerned about how many crypto wallets you'll accidentally own in 2026. Remember to stay curious, stay informed, and for the love of all things decentralized, don't sell your apartment to invest in sketchy projects. Until next time, this is Mochi, signing off with a virtual high-five!

P.S. Don't forget to share your thoughts, questions, and favorite crypto puns with us. very voice matters in the PoI community! 📣❤️ Share the newsletter

🍨📰 Catch you in the next issue! 📰🍨

Intel Drop #306

Disclaimer: The insights we share here at Proof of Intel (PoI) are all about stoking your tech curiosity, not steering your wallet. So, please don't take anything we say as financial advice. For all money matters, consult with a certified professional. -